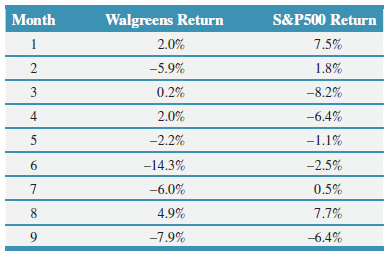

Below is nine months return data for Walgreens and the S&P 500. a. Estimate the intercept (alpha)

Question:

Below is nine months’ return data for Walgreens and the S&P 500.

a. Estimate the intercept (alpha) and beta for Walgreens stock using spreadsheet functions.

b. Interpret what the slope estimate means to a stock analyst.

c. Compute the R-squared of the regression using Excel’s RSQ function. What does the R-squared tell us about the relationship between Walgreens’ returns and those of the market?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction to Finance Markets, Investments and Financial Management

ISBN: 978-1119398288

16th edition

Authors: Ronald W. Melicher, Edgar A. Norton

Question Posted: