Question: A deep reactive ion etching (DRIE) system with an expected life of 10 years was purchased 5 years ago for $$ 175,000$ and currently has

A deep reactive ion etching (DRIE) system with an expected life of 10 years was purchased 5 years ago for $\$ 175,000$ and currently has a market value of $\$ 92,500$. Predicted operational costs the next 5 -year cycle are shown in the table below. A state grant incentive program has recently been launched that encourages capital investment for industrial modernization. A new $\$ 120,000$ DRIE has a life of 10 years and a salvage value of $\$ 12,000$. If annual operating costs are $\$ 13,222$ and the corporate MARR is $12 \%$, is this replacement a "go"?

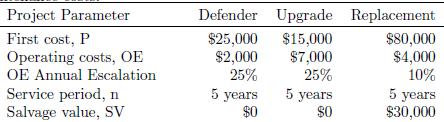

Project Parameter First cost, P Operating costs, OE OE Annual Escalation Defender Upgrade Replacement 25% $25,000 $15,000 $80,000 $2,000 $7,000 $4,000 25% 10% Service period, n Salvage value, SV 5 years 5 years 5 years $0 $0 $30,000

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

SOLUTION Okay lets analyze this replacement investment decision Current DR... View full answer

Get step-by-step solutions from verified subject matter experts