Reconsider Macrons fabric division and sportswear division described on p. 433. In addition to the data there,

Question:

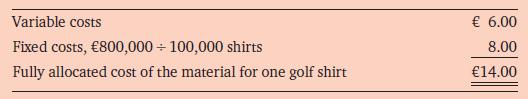

Reconsider Macron’s fabric division and sportswear division described on p. 433. In addition to the data there, suppose the fabric division has annual fixed manufacturing costs of €800,000 and expected annual production of enough fabric to make 100,000 golf shirts. The ‘fully allocated cost’ of the material for one golf shirt is as follows:

Assume that the fabric division has idle capacity. The sportswear division is considering whether to buy enough fabric for 10,000 golf shirts. It will sell each shirt for €25. The additional processing and selling costs in the sportswear division to produce and sell one shirt are €12. If Macron bases its transfer prices on fully-allocated cost, would the sportswear division manager buy? Explain. Would the company as a whole benefit if the sportswear division manager decided to buy? Explain.

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg