The wireless phone manufacturing division of a Spanish consumer electronics company uses activity-based costing. For simplicity, assume

Question:

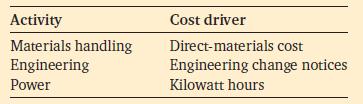

The wireless phone manufacturing division of a Spanish consumer electronics company uses activity-based costing. For simplicity, assume that its accountants have identified only the following three activities and related cost drivers for indirect production costs:

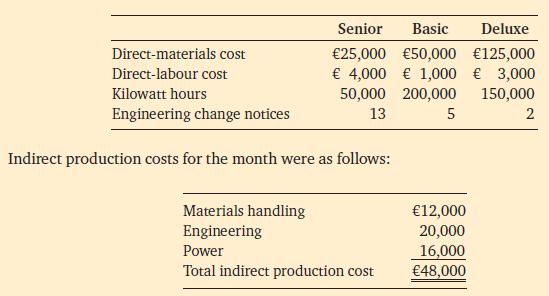

Three types of mobile phone are produced: Senior, Basic and Deluxe. Direct costs and cost-driver activity for each product for a recent month are as follows:

1. Compute the indirect production costs allocated to each product with the ABC system.

2. Suppose all indirect production costs had been allocated to products in proportion to their direct-labour costs. Compute the indirect production costs allocated to each product.

3. In which product costs, those in requirement 1 or those in requirement 2, do you have the most confidence? Why?

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg