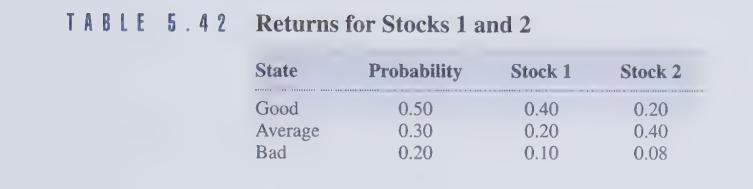

The annual returns on stocks 1 and 2 for three possible states of the economy are given

Question:

The annual returns on stocks 1 and 2 for three possible states of the economy are given in Table 5.42.

a. Find and interpret the correlation between stocks | and 2.

b. Consider another stock (stock 3) that always yields an annual return of 10%. Suppose you invest 60% of your money in stock 1, 10% in stock 2, and 30% in stock 3. Determine the standard deviation of the annual return on your portfolio.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Statistics

ISBN: 9780534389314

1st Edition

Authors: S. Christian Albright, Wayne L. Winston, Christopher Zappe

Question Posted: