Question: Refer to Problem 9. After consulting with economic professors of his alma mater, Penn State University, Mike Brusco was able to estimate the following probabilities

Refer to Problem 9. After consulting with economic professors of his alma mater, Penn State University, Mike Brusco was able to estimate the following probabilities for the three different states of nature: P (Stable Economy) = 0.3; P (Favorable Economy) = 0.5; and P (Unfavorable Economy) = 0.3.

1. What is the expected value for each investment alternative, and which one is the best?

2. If Mike hires a financial/economic analyst to get additional information about the three different states of nature, how much is this information worth?

Data from problem 9

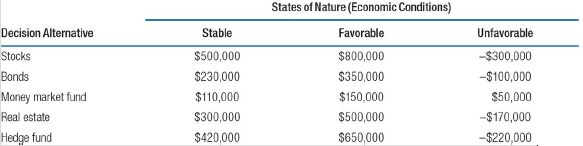

Michael Brusco has inherited a large amount of money from his aunt. He wants to invest this money for two years and is considering several short-term investment alternatives. The returns on his investment will largely depend on the state of the economy in the next two years. The various investment alternatives and their returns are given in Table F.23.

Table F.23

States of Nature (Economic Conditions) Favorable Decision Alternative Unfavorable Stable $500,000 -$300,000 Stocks Bonds $800,000 -$100,000 $50,000 -$170,000 -$220,000 $230,000 $350,000 Money market fund Real estate $110,000 $300,000 $420,000 $150,000 $500,000 $650,000 Hedge fund

Step by Step Solution

3.33 Rating (162 Votes )

There are 3 Steps involved in it

1 Using probabilities of 3 for Stable 5 f... View full answer

Get step-by-step solutions from verified subject matter experts