Question: Consider a probit model designed to explain the choice by homebuyers of fixed versus adjustable rate mortgages. The explanatory variables, with sample means in parentheses,

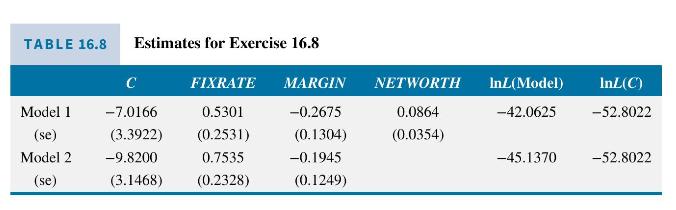

Consider a probit model designed to explain the choice by homebuyers of fixed versus adjustable rate mortgages. The explanatory variables, with sample means in parentheses, are FIXRATE (13.25) = fixed interest rate; \(\operatorname{MARGIN}(2.3)=\) the variable rate - the fixed rate; and NETWORTH \((3.5)=\) borrower's net worth \((\$ 100,000\) units). The dependent variable is \(\operatorname{ADJUST}(0.41)=1\) if an adjustable mortgage is chosen. The coefficient estimates, in Table 16.8, use 78 observations over the period January, 1983 to February, 1984.

a. What information is provided by the signs of the estimated coefficients of Model 1? Are the signs consistent with economic reasoning? Which coefficients are significant at the 5\% level?

b. Carry out a likelihood ratio test of the model significance at the \(1 \%\) level for Model 1. In Table 16.8, \(\ln L\) (Model) is the log-likelihood of the full model and \(\ln L(C)\) is the log-likelihood of the model including only the constant term.

c. What is the estimated probability of a borrower choosing an adjustable rate mortgage if FIXRATE \(=12\), MARGIN \(=2\), and NETWORTH \(=3\) ? What is the estimated probability of a borrower choosing an adjustable rate mortgage if FIXRATE \(=12\), MARGIN \(=2\), and NETWORTH \(=10\) ?

d. Carry out a likelihood ratio test of the hypothesis that NETWORTH has no effect on the choice of mortgage type, against the alternative that it does, at the \(1 \%\) level.

e. Using Model 2, what is the marginal effect of MARGIN on the probability of choosing an adjustable rate mortgage if FIXRATE \(=12\) and \(M A R G I N=2\) ?

f. Using Model 2, calculate the discrete change in the probability of choosing an adjustable rate mortgage if MARGIN increases from \(2 \%\) to \(4 \%\), while FIXRATE remains \(12 \%\) ? Is the value twice the value found in part (e)?

TABLE 16.8 Estimates for Exercise 16.8 C FIXRATE MARGIN NETWORTH InL(Model) InL(C) Model 1 -7.0166 0.5301 -0.2675 0.0864 -42.0625 -52.8022 (se) (3.3922) (0.2531) (0.1304) (0.0354) Model 2 -9.8200 0.7535 -0.1945 -45.1370 -52.8022 (se) (3.1468) (0.2328) (0.1249)

Step by Step Solution

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts