Cascade Industries has the following account balances: The company wishes to raise $50,000 in cash and is

Question:

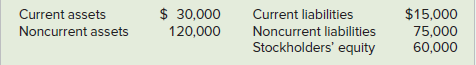

Cascade Industries has the following account balances:

The company wishes to raise $50,000 in cash and is considering two financing options: Cascade can sell $50,000 of bonds payable, or it can issue additional common stock for $50,000. To help in the decision process, Cascade’s management wants to determine the effects of each alternative on its current ratio and debt-to-assets ratio.

Required

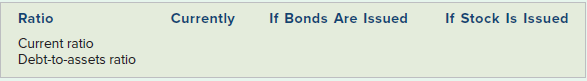

a. Help Cascade’s management by completing the following chart:

b. Assume that after the funds are invested, EBIT amounts to $18,000. Also assume the company pays $5,000 in dividends or $5,000 in interest, depending on which source of financing is used. Based on a 30 percent tax rate, determine the amount of the increase in retained earnings that would result under each financing option.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds