An investor is considering adding three new securities to her internationally focused, fixed-income portfolio. She considers the

Question:

An investor is considering adding three new securities to her internationally focused, fixed-income portfolio. She considers the following non-callable securities:

• 1-year government bond

• 10-year government bond

• 10-year BBB rated corporate bond She plans to invest equally in all three securities being analyzed or will invest in none of them at this time. She will only make the added investment provided that the expected spread/premium of the equally weighted investment is at least 1.5 percent

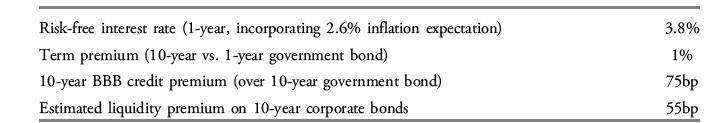

(150bp) over the 1-year government bond. She has gathered the following information:

Using only the information given, address the following problems using the risk premium approach:

A. Calculate the expected return that an equal-weighted investment in the three securities could provide.

B. Calculate the expected total risk premium of the three securities and determine the investor’s probable course of action.

Step by Step Answer: