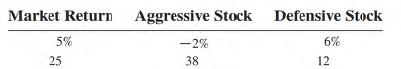

Question: Consider the following table, which gives a security analyst's expected return on two stocks in two particular scenarios for the rate of return on the

Consider the following table, which gives a security analyst's expected return on two stocks in two particular scenarios for the rate of return on the market:

a. What are the betas of the two stocks?

b. What is the expected rate of return on each stock if the two scenarios for the market return are equally likely?

c. If the T-bill rate is 6% and the market return is equally likely to be 5% or 25%, draw the SML for this economy.

d. Plot the two securities on the SML graph. What are the alphas of each?

e. What hurdle rate should be used by the management of the aggressive firm for a project with the risk characteristics of the defensive firm's stock?

Market Return Aggressive Stock Defensive Stock 5% 25 -2% 38 6% 12

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

a Call the aggressive stock A and the defensive stock D Beta is the sensitivity of the stocks return ... View full answer

Get step-by-step solutions from verified subject matter experts