Heinrich Gladisch, CFA, is estimating the justified forward P/E for Nestle (SIX: NESN), one of the worlds

Question:

Heinrich Gladisch, CFA, is estimating the justified forward P/E for Nestle´ (SIX:

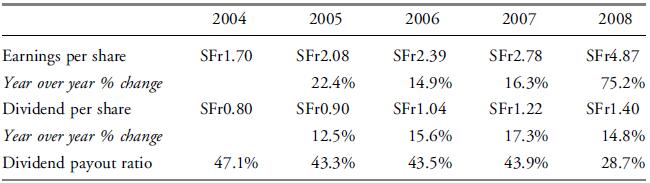

NESN), one of the world’s leading nutrition and health companies. Gladisch notes that sales for 2008 were SFr109.9 billion (US$101.6 billion) and that net income was SFr18.0 billion (US$16.6 billion). He organizes the data for EPS, dividends per share, and the dividend payout ratio for the years 2004–2008 in the following table:

Gladisch calculates that ROE averaged slightly more than 19 percent in the period 2004–2007 but jumped to about 35 percent in 2008. In 2008, however, Nestle´’s reported net income included a large nonrecurring component. The company reported 2008 “underlying earnings,” which it defined as net income “from continuing operations before impairments, restructuring costs, results on disposals and significant oneoff items,” to be SFr2.82. Predicting increasing pressure on Nestle´’s profit margins from lower-priced goods, particularly in developed markets, Gladisch estimates a longrun ROE of 16 percent.

Gladisch decides that the dividend payout ratios of the 2004–2007 period—

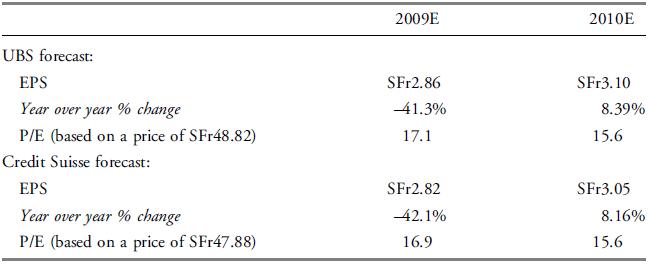

averaging 44.5 percent—are more representative of Nestle´’s future payout ratio than is the low 2008 dividend payout ratio. The dividend payout ratio in 2008 was lower because management apparently based the 2008 dividend on the components of net income that were expected to continue into the future. Basing a dividend on net income including nonrecurring items creates the potential need to reduce dividends in the future. Rounding up the 2004–2007 average, Gladisch settles on an estimate of 45 percent for the dividend payout ratio for use in calculating a justified forward P/E using Equation 10.14. Gladisch’s firm estimates that the required rate of return for Nestle´’s shares is 12 percent per year. Gladisch also finds the following data in UBS and Credit Suisse analyst reports dated, respectively, 9 December 2009 and 16 October 2009:

Gladisch’s firm estimates that the required rate of return for Nestle´’s shares is 12 percent per year. Gladisch also finds the following data in UBS and Credit Suisse analyst reports dated, respectively, 9 December 2009 and 16 October 2009:

1. Based only on information and estimates developed by Gladisch and his firm, estimate Nestle´’s justified forward P/E.

2. Compare and contrast the justified forward P/E estimate from Question 1 to the estimates from UBS and Credit Suisse.

Step by Step Answer:

Investments Principles Of Portfolio And Equity Analysis

ISBN: 9780470915806

1st Edition

Authors: Michael McMillan, Jerald E. Pinto, Wendy L. Pirie, Gerhard Van De Venter, Lawrence E. Kochard