Consider the returns between Southeast Utilities and Precision Instruments for the period 20052014. The summary statistics for

Question:

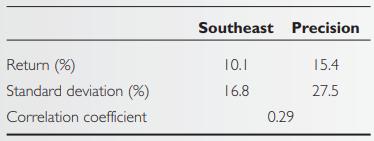

Consider the returns between Southeast Utilities and Precision Instruments for the period 2005–2014. The summary statistics for these two stocks are as follows:

Assume, for expositional purposes, we place equal amounts in each stock; therefore, the weights are 0.5 and 0.5:

![o = [w0 + w0 + 2(w)(w) (P2)0102]/ 1/2 =[(0.5) (16.8) + (0.5) (27.5) +2(0.5) (0.5)(0.29) (16.8) (27.5) ]/ =](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1703/4/0/2/4126587dbac49cad1703402409327.jpg)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen

Question Posted: