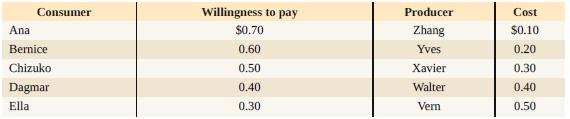

The accompanying table shows five consumers willingness to pay for one can of diet soda each, as

Question:

The accompanying table shows five consumers’ willingness to pay for one can of diet soda each, as well as five producers’ costs of selling one can of diet soda each.

Each consumer buys at most one can of soda; each producer sells at most one can of soda. The government asks your advice about the effects of an excise tax of $0.40 per can of diet soda. Assume that there are no administrative costs from the tax.

a. Without the excise tax, what is the equilibrium price and the equilibrium quantity of soda transacted?

b. The excise tax raises the price paid by consumers post-tax to $0.60 and lowers the price received by producers post-tax to $0.20. With the excise tax, what is the quantity of soda transacted?

c. Without the excise tax, how much individual consumer surplus does each of the consumers gain? How much with the tax? How much total consumer surplus is lost as a result of the tax?

d. Without the excise tax, how much individual producer surplus does each of the producers gain? How much with the tax? How much total producer surplus is lost as a result of the tax?

e. How much government revenue does the excise tax create?

f. What is the deadweight loss from the imposition of this excise tax?

Step by Step Answer: