Question: Consider two bonds, one issued in euros ( () ) in Germany, and one issued in dollars ($) in the United States. Assume that both

Consider two bonds, one issued in euros ( \(€\) ) in Germany, and one issued in dollars (\$) in the United States. Assume that both government securities are one-year bonds-paying the face value of the bond one year from now. The exchange rate, E, stands at 0. 75 euros per dollar.

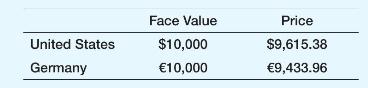

The face values and prices on the two bonds are given by

a. Compute the nominal interest rate on each of the bonds.

b. Compute the expected exchange rate next year consistent with uncovered interest parity.

c. If you expect the dollar to depreciate relative to the euro, which bond should you buy?

d. Assume that you are a US investor and you exchange dollars for euros and purchase the German bond today. One year from now, it turns out that the exchange rate, \(E\), is actually 0.72 ( 0.72 euros buys one dollar). What is your realized rate of return in dollars compared to the realized rate of return you would have made had you held the US bond?

e. Are the differences in rates of return in part d consistent with the uncovered interest parity condition? Why or why not?

Face Value Price United States $10,000 $9,615.38 Germany 10,000 9,433.96

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts