When the government runs a budget surplus (T > G), it deposits any unspent tax revenue into

Question:

a. Draw a diagram of the loanable funds market with a budget surplus, showing the equilibrium interest rate and quantity of funds demanded and supplied.

b. Prove that when the loanable funds market is in equilibrium, total leakages (S + T) are equal to total injections (Ip+ G).

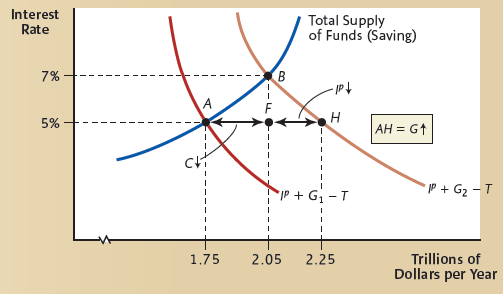

c. Show (on your graph) what happens when government purchases increase, identifying any decrease in consumption and planned investment on the graph (similar to what was done in the following figure).

d. When the government is running a budget surplus, does an increase in government purchases cause complete crowding out? Explain briefly.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Macroeconomics Principles and Applications

ISBN: 978-1111822354

6th edition

Authors: Robert E. Hall, Marc Lieberman

Question Posted: