Point Piper prepares monthly cash budgets. Provided below is a set of relevant data extracted from existing

Question:

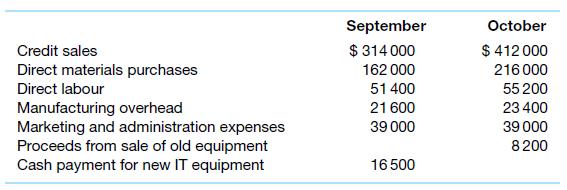

Point Piper prepares monthly cash budgets. Provided below is a set of relevant data extracted from existing reports, and the sub-budgets for the months of September and October.

All sales are on credit. Collections from debtors normally have the following pattern: 60 per cent in the month of sale, 30 per cent in the month following the sale, and 10 per cent in the second month following the sale. Fortunately, Point Piper does not have much trouble with bad debts.

Sales in June, July and August were $295 000, $266 000 and $302 000 respectively. Direct material purchases are paid for in the month following the purchase. Purchases in August were $182 000.

Manufacturing overhead includes $12 500 for depreciation expense, while the marketing and administration expenses include an amount of $5600 for depreciation expenses. Point Piper expects to be able to repay the principal on a $50 000 loan in October.

Required

(a) Prepare a schedule of receipts from debtors for the two months ending 31 October.

(b) Prepare a cash budget for September and October. The cash balance at 31 August was $12 600.

(c) As part of its longer-term plans, management was hoping to commence a product reinvention program for one of its core products. The project would require an initial cash commitment of $30 000. Management was hoping to fund this from the cash flows of the business. Does this seem feasible?

Step by Step Answer:

Management Accounting

ISBN: 9780730369387

4th Edition

Authors: Leslie G. Eldenburg, Albie Brooks, Judy Oliver, Gillian Vesty, Rodney Dormer, Vijaya Murthy, Nick Pawsey