You are employed as the accountant for Cars Ltd, a local garage which has a bodyshop. The

Question:

You are employed as the accountant for Cars Ltd, a local garage which has a bodyshop. The bodyshop manager, Mr George, has contacted you saying that one of the company’s present customers has offered the company a one-year contract for additional work. The customer requires a discount of 10% to be allowed on the total invoice value. Mr George provides you with the following information:

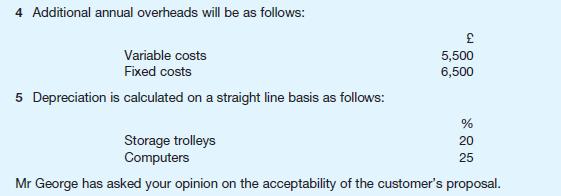

1 Additional capital expenditure will be:

The customer insists on installation of the video conferencing facility which will not be usable for any other contract. The storage trolleys and estimating system may be used on other work after the end of this particular contract.

2 Additional staff will be required. Three full-time skilled technicians earning £8.00 per hour will each work 39 hours per week on the new contract. They are each allowed 6 weeks per year paid holidays and 2 weeks paid training. Labour efficiency is 95% measured as the ratio of sold hours/hours attended. Training time and holiday time are charged to direct costs of the department. For each technician the new contract will leave some unsold hours available for any other jobs coming into the bodyshop. One full-time car cleaner will be required earning £10,500 per annum.

3 The customer has said that the potential increase in sales due to chargeable hours from this contract could be 4,500 hours at a rate of £20.00 per hour before discount. In addition the increase in sales of car parts is calculated on the basis of £40.00 per hour with an average gross profit of 15% before discount. The increase in paint sales is calculated on the basis of £3.50 per hour with an average gross profit of 40% before discount.

Required Write a memo to Mr George:

(a) assessing the financial aspects of the proposal; and

(b) commenting briefly on other considerations relevant to the decision-making process.

Step by Step Answer: