Question: Audio Components Ltd. recently installed a backflush costing system. One department makes speakers with a standard cost as follows: Speakers are scheduled for production only

Audio Components Ltd. recently installed a backflush costing system.

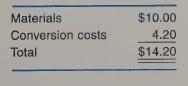

One department makes speakers with a standard cost as follows:

Speakers are scheduled for production only after orders are received, and products are shipped to customers immediately upon completion. Therefore, no finished goods inventories are kept, and product costs are applied directly to cost of goods sold.

In October, 1,500 speakers were produced and shipped to customers.

Materials were purchased at a cost of $16,000, and actual conversion costs (labour plus manufacturing overhead) of $6,300 were recorded.

1. Prepare journal entries to record October’s costs for the production of speakers.

2. Suppose October's actual conversion costs had been $5,900 instead of $6,300. Prepare a journal entry to recognize overapplied conversion costs.

Materials Conversion costs Total $10.00 4.20 $14.20

Step by Step Solution

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts