Question: Consider the following summarized data regarding 2010: Omit explanations for journal entries. 1. Prepare a summary journal entry for the actual overhead incurred for 2010.

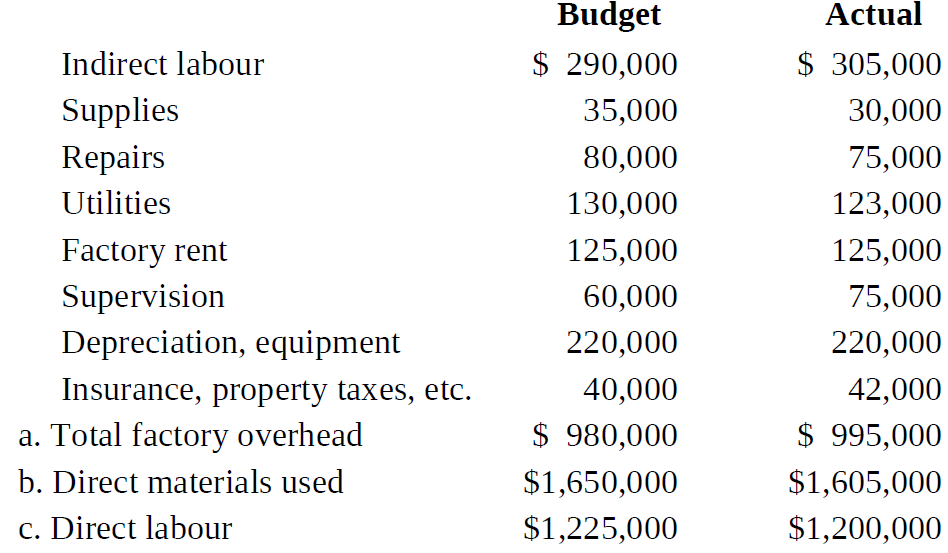

Consider the following summarized data regarding 2010:

Omit explanations for journal entries.

1. Prepare a summary journal entry for the actual overhead incurred for 2010.

2. Prepare summary journal entries for direct materials used and direct labour.

3. Factory overhead was applied by using a budgeted rate based on budgeted direct labour costs. Compute the rate. Prepare a summary journal entry for the application of overhead to products.

4. Post the journal entries to the T-accounts for work-in-process and factory department overhead.

5. Suppose over applied or under applied factory overhead is written off as an adjustment to cost of goods sold. Prepare the journal entry. Post the overhead to the overhead T-account.

Budget Actual $ 305,000 $ 290,000 Indirect labour Supplies 35,000 30,000 Repairs 75,000 80,000 Utilities 130,000 123,000 Factory rent Supervision 125,000 125,000 60,000 75,000 220,000 Depreciation, equipment 220,000 40,000 42,000 Insurance, property taxes, etc. $ 980,000 $ 995,000 a. Total factory overhead b. Direct materials used $1,650,000 $1,605,000 c. Direct labour $1,225,000 $1,200,000

Step by Step Solution

3.52 Rating (169 Votes )

There are 3 Steps involved in it

1 Factory department overhead control 995000 Cash accounts payable and various accounts 995000 2 ... View full answer

Get step-by-step solutions from verified subject matter experts