Dolphin Radiators & Cooling Systems Ltd of Sharjah, United Arab Emirates, is a supplier to the global

Question:

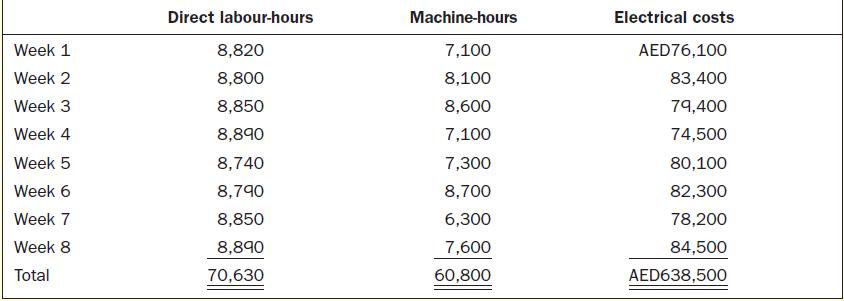

Dolphin Radiators & Cooling Systems Ltd of Sharjah, United Arab Emirates, is a supplier to the global automobile industry. The company specializes in radiators and brake linings. The company has a traditional job-cost system in which direct materials and direct labour costs are assigned directly to jobs, but factory overhead is applied using direct labour-hours as a base. Management primarely uses this job-cost data for valuing cost of goods sold and inventories for external reports. For internal decision making, management do not use this cost data since direct labour costs are basically fixed. In addition management believes that overhead costs actually have little to do with direct labour-hours. Recently, management has become interested in activity-based costing (ABC) as a way of estimating job costs and other costs for decisionmaking purposes. Management assembled a cross-functional team to design a prototype ABC system. Electrical cost was one of the factory overhead costs first investigated by the team. Electricity is used to provide light, to power equipment and to heat the building in the winter and cool it in the summer. The ABC team proposed allocating electrical costs to jobs based on machine-hours since running the machines consumes significant amounts of electricity. Data assembled by the team concerning actual direct labour-hours, machine-hours and electrical costs over a recent eight-week period appear below. (The United Arab Emirates currency is the dirham (AED), which is denoted by AED.)

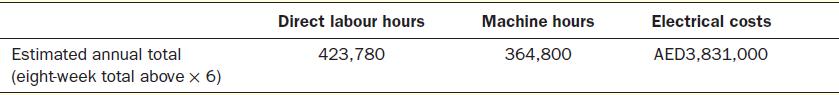

To help assess the effect of the proposed change to machine-hours as allocation base, the eight-week totals were converted to annual figures by multiplying them by six.

Required

1. Using the estimated annual totals from the above table compute the company’s predetermined overhead rate. What would the predetermined overhead rate for electrical costs be if the allocation base is direct labour-hours? Machine-hours?

2. Dolphin Radiators & Cooling Systems Ltd intends to bid on a job that would require 340 direct labour-hours and 280 machine-hours. How much electrical cost would be charged to this job using the predetermined overhead rate computed in 1 above if the allocation base is direct labour-hours? Machine-hours?

3. Prepare a scattergraph in which you plot direct labour-hours on the horizontal axis and electrical costs on the vertical axis. Prepare another scattergraph in which you plot machine-hours on the horizontal axis and electrical costs on the vertical axis. Do you agree with the ABC team that machine-hours is a better allocation base for electrical costs than direct labour-hours?

4. Using machine-hours as the measure of activity, estimate the fixed and variable components of electrical costs using either the scattergraph (i.e., visual fit) method or least-squares regression.

5. How much electrical cost do you think would actually be caused by the job in Question 2 above?

6. What other factors than direct labour-hours and machine-hours, are likely to affect consumption of electrical power in the company?

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen