Question: Following on from the information provided in example 4: (a) Calculate the internal rate of return of Project A. Use the project NPV of $$

Following on from the information provided in example 4:

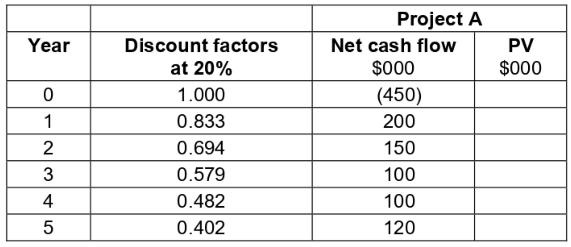

(a) Calculate the internal rate of return of Project A. Use the project NPV of $\$ 73,620$ at $10 \%$ from example 4 , and calculate a second NPV at a $20 \%$ discount rate, before using the IRR formula.

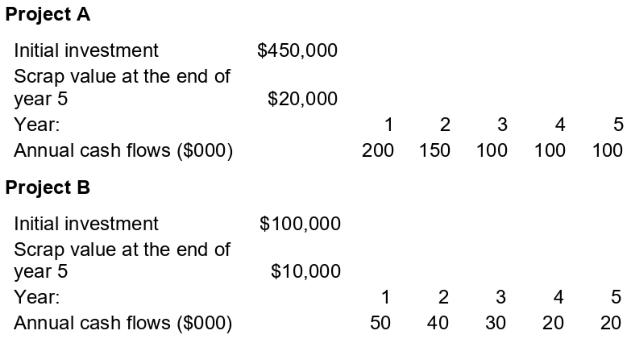

(b) Calculate the internal rate of return of Project B.

You are given the following:

At $10 \%$ the NPV was $\$ 33,310$

At $20 \%$ the NPV is $\$ 8,510$

At $30 \%$ the NPV is $(\$ 9,150)$

Data from Example 4

Mickey Ltd is considering two mutually-exclusive projects with the following details:

Assume that the initial investment is at the start of the project and the annual cash flows are at the end of each year.

Project A Year Discount factors Net cash flow PV at 20% $000 $000 0 1.000 (450) 1 0.833 200 2 0.694 150 34 0.579 100 4 0.482 100 5 0.402 120

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts