Job-order costing is usually identified with manufacturing companies. However, service industries and non-profit organizations also use the

Question:

Job-order costing is usually identified with manufacturing companies. However, service industries and non-profit organizations also use the method. Suppose a social service agency has a cost accounting system that tracks cost by department (for example, family counselling, general welfare, and foster children) and by case. In this way, the manager of the agency is better able to determine how its limited resources (mostly professional social workers) should be allocated. Furthermore, the manager’s interactions with superiors and various politicians are more fruitful when they can cite the costs of various types of cases.

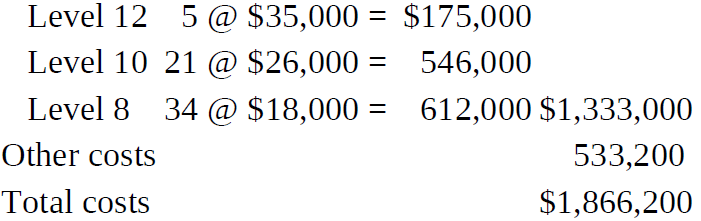

The condensed line-item budget for the general welfare department of the agency for 2011 showed the following:

Professional salaries:

For costing various cases, the manager favoured using a single overhead application rate based on the ratio of total overhead to direct labour. The latter was defined as those professional salaries assigned to specific cases.

The professional workers filled out a weekly “case time ?report, which approximated the hours spent for each case. The instructions on the report were: “Indicate how much time (in hours) you spent on each case. Unassigned time should be listed separately. ?About 20 percent of available time was unassigned to specific cases. It was used for professional development (for example, continuing-education programs). “Unassigned time ?became a part of “overhead, ?as distinguished from the direct labour.

1. Compute the “overhead rate ?as a percentage of direct labour (that is, the assignable professional salaries).

2. Suppose that last week a welfare case, Client No. 273, required two hours of Level-12 time, four hours of Level-10 time, and nine hours of Level-8 time. How much job cost should be allocated to Client No. 273 for the week? Assume that all professional employees work an 1,800-hour year.

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu