The managing partner of Brenda McCoy Accounting is considering the desirability of tracing more costs to jobs

Question:

The managing partner of Brenda McCoy Accounting is considering the desirability of tracing more costs to jobs than just direct labour. In this way, the firm will be better able to justify billings to clients.

Last year’s costs were

Direct professional labour ..................................................$ 5,000,000

Overhead ...............................................................................10,000,000

Total costs ............................................................................$15,000,000

The following costs were included in overhead:

Computer time .......................................................................................$ 750,000

Secretarial costs ........................................................................................700,000

Photocopying ............................................................................................250,000

Employee benefits for direct labour ......................................................800,000

Phone call time with clients (estimated but not tabulated) ................500,000

Total ......................................................................................................$3,000,000

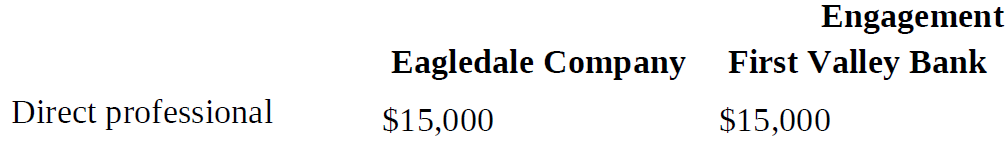

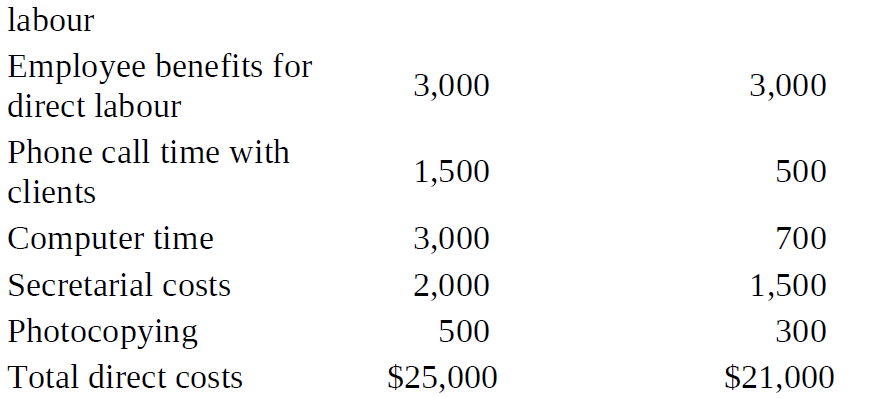

The firm’s data-processing techniques now make it feasible to document and trace these costs to individual jobs. As an experiment in December, Brenda McCoy arranged to trace these costs to six audit engagements. Two job records showed the following:

1. Compute the overhead application rate based on last year’s costs.

2. Suppose last year’s costs were reclassified so that $3 million would be regarded as direct costs instead of overhead. Compute the overhead application rate as a percentage of direct labour and as a percentage of total direct costs.

3. Using the three rates computed in requirements 1 and 2, compute the total costs of engagements for Eagledale Company and First Valley Bank.

4. Suppose that client billing was based on a 30 percent markup of total job costs. Compute the billings that would be forthcoming in requirement 3.

5. Which method of job costing and overhead application do you favour? Explain.

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu