Management of Consolidated Industries Inc. is considering closing its Oilfield Supply Manufacturing Division due to unfavourable and

Question:

Management of Consolidated Industries Inc. is considering closing its Oilfield Supply Manufacturing Division due to unfavourable and uncertain conditions in the oil markets. Each of the following three points addresses one financial impact of this decision.

1. Manufacturing equipment in Oilfield Supply was purchased three years ago for $12 million cash. This equipment is depreciated on a straight-line basis over six years with zero salvage value expected after six years. Accumulated depreciation on this equipment on the date of closure would be $6 million, and the salvage value on that date would be $1.5 million. What is the financial benefit or loss related to disposing of this equipment?

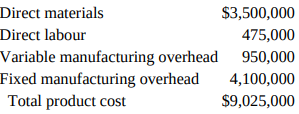

2. Oilfield Supply has an inventory of choke parts that in total has been assigned the following costs by its job-order costing system:

Management estimates that this inventory could be sold at the closure date for approximately 25 percent of prime cost. What is the financial benefit or loss related to disposing of this inventory?

3. Machinery originally purchased one year ago for $900,000 cash by Oilfield Supply could be sold on the closure date for a salvage value of $450,000. Accumulated depreciation on this equipment on the date of closure would be $125,000 and it would have had an additional useful life of three more years, at which time it would have no salvage value. Alternatively, this machinery could be disassembled and packaged as parts for a cost of $20,000. Management estimates that the parts could be sold for a total of $490,000. What is the financial benefit or loss related to disposing of this equipment?

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu