Part A: Millie Bandes, a successful entrepreneur, is setting up a new division for the manufacture of

Question:

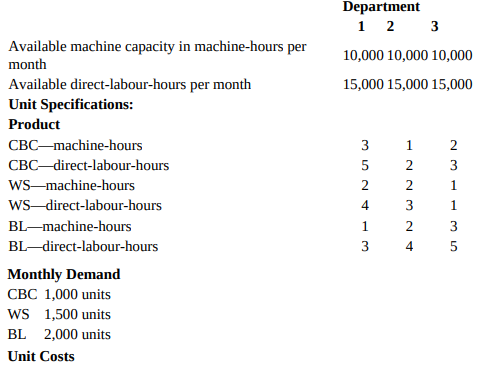

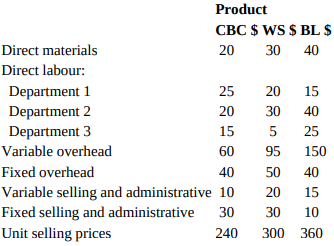

Part A: Millie Bandes, a successful entrepreneur, is setting up a new division for the manufacture of three new products that will complement her current line of business. Millie is currently involved in the manufacture of motorboats. She believes that overall corporate profits can be enhanced by manufacturing custom boat covers (CBC), waterskis (WS), and boat ladders (BL) in her new division and has asked you to assist her in planning a production schedule for the next month. The three products will be manufactured in a plant with three departments. As the products proceed through each department, applicable labour and machine time are applied. Each department is composed of specialized machinery and specialized labour skills and, accordingly, neither machine time nor labour time can be switched between departments. The following data have been accumulated by Millie:

Other information:

Since the business is seasonal and space is limited, Millie has asked you to assume zero inventory and work-in-process at the end of each month. Unit fixed costs are based on sufficient monthly production to meet sales demand. Fixed overhead costs for a given product are incurred only if that product is produced.

Required

1. Prepare a monthly production schedule for one month only that will maximize the division’s profit given the above information, and prepare a schedule of estimated divisional profit.

2. What steps would you advise Millie to consider for next year in order to further enhance her divisional profit?

Part B Millie’s banker is convinced that only the custom boat covers (CBC) should be manufactured. In order to authorize a long-term bank loan for equipment and an operating line of credit for day-to-day operations, the banker requires a three-month schedule of cash flows that will identify the amount of operating line of credit required and illustrate the division’s ability to adhere to the long-term loan repayment schedule and maintain adequate collateral for the operating line of credit. Millie has provided the following additional information in this regard:

1. All of the data described in Part A will be valid for the entire threemonth period.

2. Millie will deposit $100,000 into the division’s bank account as startup funds.

3. Direct material for one month’s production is ordered in the month prior to production, is delivered on the first day of the month of production, and is paid for in the month of production.

4. Fixed costs are paid for in the month of production.

5. Variable selling expenses are paid for in the month of production.

6. Anticipated cash flows from sales are as follows: 20 percent of monthly sales will be cash sales; 80 percent of monthly sales will be credit sales with 30-day net terms; and 10 percent of credit sales are expected to be uncollectible.

7. The division will require a term loan of $120,000 in order to purchase equipment for the production of custom boat covers. The bank has agreed to a 12 percent annual interest rate for 60 months with payments at the end of each month of $2,000 principal plus interest. The term loan proceeds will be advanced and the equipment will be purchased at the beginning of the first month.

8. The required operating funds (as per the cash-flow statement) will be advanced at the beginning of each month to a maximum of 75 percent of the anticipated collectible receivables, as at the end of the month the operating line of credit funds are advanced. Operating line of credit funds are advanced in multiples of $20,000.

9. Interest expense on the operating line of credit funds, charged at an annual rate of 18 percent, is to be minimized subject to a desired minimum cash-on-hand balance of $15,000. Any repayments of operating line of credit funds will be made at the end of the month and can be made only in multiples of $10,000.

Required

Prepare the three-month schedule of cash flows required by the banker. (Your schedule should include four numeric columns: one column for each of the three months and one column containing the totals for the three months. The columns should only include cash flows pertaining to custom boat covers (CBC). All information available relating to custom boat covers (CBC) should be utilized. C11-4 Cash Budgeting (CG

Line of CreditA line of credit (LOC) is a preset borrowing limit that can be used at any time. The borrower can take money out as needed until the limit is reached, and as money is repaid, it can be borrowed again in the case of an open line of credit. A LOC is...

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu