The Mendoza Company is installing an absorption standard costing system and a flexible overhead budget. Standard costs

Question:

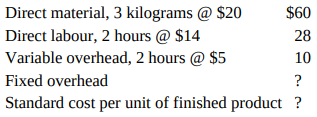

The Mendoza Company is installing an absorption standard costing system and a flexible overhead budget. Standard costs have recently been developed for its only product and are as follows:

Expected production activity is expressed as 7,500 standard directlabour-hours per month. Fixed overhead is expected to be $60,000 per month. The predetermined fixed overhead rate for product costing is not changed from month to month.

1. Calculate the proper fixed overhead rate per standard direct-labourhour and per unit.

2. Graph the following for activity from zero to 10,000 hours:

1. Budgeted variable overhead

2. Variable overhead applied to product

3. Graph the following for activity from zero to 10,000 hours:

1. Budgeted fixed overhead

2. Fixed overhead applied to product

4. Assume that 6,000 standard direct-labour-hours are allowed for the output achieved during a given month. Actual variable overhead of $30,600 was incurred: actual fixed overhead amounted to $62,000. Calculate the

1. Fixed overhead budget variance

2. Fixed overhead volume variance

3. Variable overhead spending variance

5. Assume that 7,800 standard direct-labour-hours are allowed for the output achieved during a given month. Actual overhead incurred amounted to $99,700, $62,200 of which was fixed. Calculate the

1. Fixed overhead budget variance

2. Fixed overhead volume variance

3. Variable overhead spending variance

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu