Toms Outdoor Experience (TOE) is a sporting goods store owned by Tom Dennison. Tom handles limited product

Question:

Tom’s Outdoor Experience (TOE) is a sporting goods store owned by Tom Dennison. Tom handles limited product lines. Summer sales centre on bicycles, camping gear, and clothing for both activities. Crosscountry skis and related equipment and clothing are the major winter lines. The store is a year-round centre for running enthusiasts because better footwear and clothing for this sporting activity are featured. The store is situated in a small city in Ontario.

Operations began 14 years ago when Tom purchased the building that houses the store. The business provided adequate cash flow to raise a family of three children. Now that the children are grown, Tom’s wife has resumed her career. Tom has decided to open a new store in a nearby city as he is certain there is an available market.

Tom has been a close friend of your family for many years. In April 2010, he telephoned to ask your advice about preparing a presentation to his banker so that he could proceed with his expansion plans. The conversation proceeded as follows:

Tom: I spoke to the bank manager about borrowing $200,000 to buy that building, clean it up a little, and install some equipment. The building, at $175,000, is a good buy according to the real estate agent. I got a $15,000 quote from a contractor to do the renovations it requires. I think that $10,000 is enough to buy a cash register, display racks, and the little pieces of equipment needed to repair bikes and skis.

You: I guess the banker needs some collateral and some indication that you’ll be able to repay the loan.

Tom: That’s right. And that’s where I thought you might be able to help. Tell me what you think he wants and how to put it together.

You: He probably wants to see cash-flow statements and anticipated results for the new location. Do you have financial statements prepared?

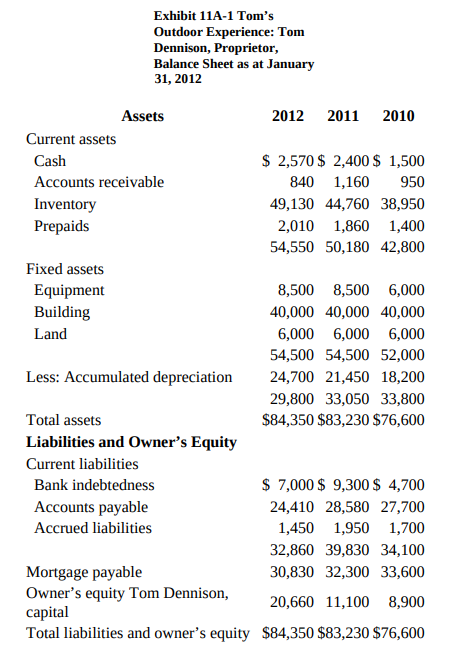

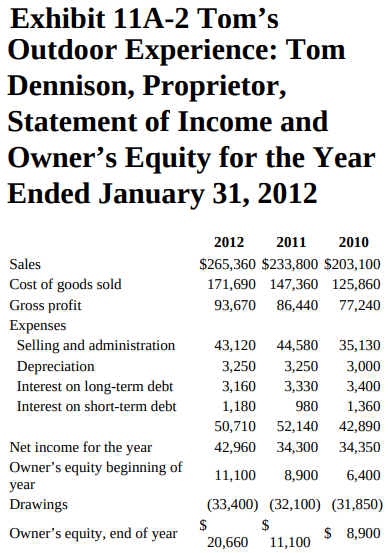

Tom: Yes, the January 31, 2012, year-end balance sheet and income statements are done. [See Exhibits 11A-1 and 11A-2.] I also have written a list of things that I expect will happen with the new store. [See Exhibit 11A-3.)

You: Good. Have you borrowed money from this bank before?

Tom: Yes, I have a line of credit with them, and I’m still paying the $386 per month on the mortgage of the old store. The banker says my credit rating is good, and that I could probably get both long- and shortterm money at 12 percent. I asked him if a working capital loan of $20,000 for the new store would be possible. He said that he would consider it at the same time as the new building package.

You: You seem to have thought this out thoroughly. Tom: If I brought over the documentation, could we put something together tonight? I’m seeing the banker tomorrow morning. If you can do the numbers, I can justify the marketing aspects. I’d really like to know what you think about this new venture. You: Sure, Tom. I’ll see you about 7:30.

Exhibit 11A-3 Basis of Projections for New Store Prepared by Tom Dennison 1. The deal for the store will close May 31 if financing is secured. This will allow time for renovations and inventory stocking. Projected opening date: August 1, 2012. 2. Sales in the old store are expected to increase by a minimum of 15 percent per year during the next few years since fitness is becoming an essential part of many lifestyles. Sales in the new store in the first six months will be about 80 percent of the projected results in the old store, then will equal or better the level of the old store. I expect better sales because the new store is in a larger community and the store area is larger. 3. Profit margins in the old store have slipped slightly in past years because of pressure from the chain stores. With two stores, purchasing economies will ensure that my profit margin won’t slip more than one percent per year. I am even expecting a slight recovery because we provide excellent service on all equipment. Customers appreciate that and are willing to pay for it. 4. Selling and administration expenses have levelled off because we are using more part-time staff. I expect that in addition to the regular costs, I’ll have to pay about $5,000 per year more for one of the staff to act as a manager. 5. Drawings can be reduced to $15,000 per year. My wife’s income is more than sufficient for living expenses, since our house mortgage has been paid.

Tom arrived at your evening meeting with his documentation and financial statements. He assured you that he could have the presentation typed in the morning before his meeting with the banker.

Required

Prepare the necessary quantitative and qualitative analysis that would help Tom present his request to his banker. State any assumptions you make.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Line of Credit

A line of credit (LOC) is a preset borrowing limit that can be used at any time. The borrower can take money out as needed until the limit is reached, and as money is repaid, it can be borrowed again in the case of an open line of credit. A LOC is...

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu