Tsumagari Company, an electronics company in Kobe, Japan, is planning to buy new equipment to produce a

Question:

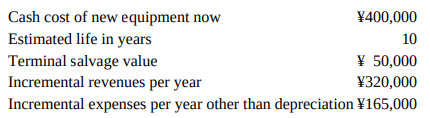

Tsumagari Company, an electronics company in Kobe, Japan, is planning to buy new equipment to produce a new product. Estimated data are:

Assume a 60 percent flat rate for income taxes. All revenues and expenses other than depreciation will be received or paid in cash. Use a 14 percent discount rate. Assume a 10-year straight-line depreciation for tax purposes. Also assume that the terminal salvage value will affect the depreciation per year.

Compute

1. Depreciation expense per year

2. Anticipated net income per year

3. Annual net cash flow

4. Payback period

5. Accounting rate of return on initial investment

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at...

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu