Ydeeps Limited was incorporated under the Ontario Business Corporations Act four months ago. The owner of Ydeeps,

Question:

Ydeeps Limited was incorporated under the Ontario Business Corporations Act four months ago. The owner of Ydeeps, Mr. M. Sadim, incorporated the company because he believed that he would be investing in an automobile repair franchise. After a delay, Sadim has been able to assemble the following information about the franchise opportunity:

1. For a payment of $32,000 per year, payable at the beginning of each year, the franchisee would be entitled to exclusive rights in a territory. The franchise rights are non-transferable. Except in unusual circumstances, the payments would be made for five years and entitle the franchisee to one repair location. In addition to the annual franchise fee, the franchisee would be required to pay an annual royalty of 3 percent of gross revenue.

2. A site is available to construct a repair facility. The land would cost $250,000 and a suitable building would cost $400,000. The building would be capable of handling about $1,500,000 of revenue per year and would have a life of 40 years. A mortgage for about $500,000 could be placed on the property at an interest rate of 12 percent per annum.

3. At the end of 10 years, the repair building and land probably could be sold for $1,300,000 to $1,500,000.

4. The site that Sadim has an opportunity to invest in is in the middle of a busy region in which two taxi companies compete. Sadim believes that he would have little difficulty obtaining all of the repair work for one of the taxi companies that has 210 automobiles. He believes that a two-year contract could be signed to generate revenue of $400,000 to $450,000 per year. In addition, Sadim believes that he has a good probability of obtaining the following repair revenue from different sources:

First year $200,000 – $300,000

Thereafter, each year $450,000 – $550,000

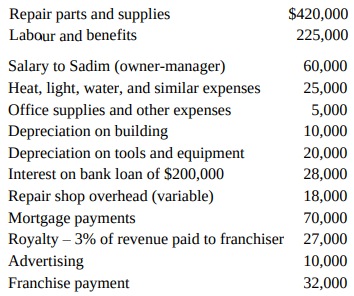

5. In order to generate repair revenue of $900,000 per year, Sadim believes that Ydeeps’s annual expenses probably would be

Most of the operating costs would be variable except for Sadim’s salary, advertising, and the franchise fee.

6. The franchiser has provided the following estimates of the investment (except for land and building) that would be required to support a franchisee having repair revenue of roughly $1,000,000 per year:

Equipment and tools.....................$200,000

Receivables due from customers..150,000

Inventory on hand.............................60,000

Accounts payable..............................10,000

7. Sadim believes that he can obtain repair work of about $300,000 per year from a car rental company if he gives them a 20 percent discount (from the $375,000 regular price). Variable costs of repairing these cars would be similar to the costs that would be encountered to earn the $900,000 of revenue. Sadim believes that other contracts are possible if discounts are given. Sadim would like a return on investment of 40 percent on any of the dollar investments that he personally makes. However, an overall required rate of return is estimated to be 22 percent.

Required

Sadim has asked you to prepare a report on the feasibility of operating a repair franchise. If the franchise would not be feasible under the above conditions, explain if and how feasibility could be attained. Recommend what decisions he should make with respect to signing a contract to be a franchisee and to any other alternatives that exist. Income tax effects should be ignored.

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu