Zwann Systems develops and manufactures residential water filtration units that are installed under the sink. The filtration

Question:

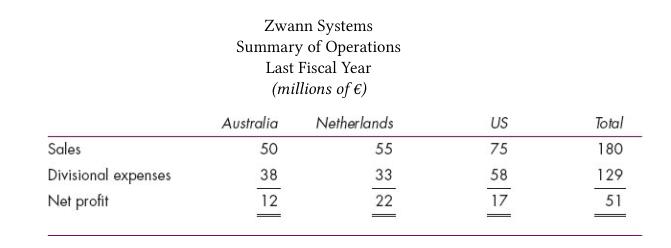

Zwann Systems develops and manufactures residential water filtration units that are installed under the sink. The filtration unit removes chlorine and other chemicals from drinking water. This Dutch company has successfully expanded sales of its units in the European market for the past 12 years. Six years ago, Zwann started a US manufacturing and marketing division and three years ago, an Australian manufacturing and marketing division. Summary operating data for the last fiscal year are:

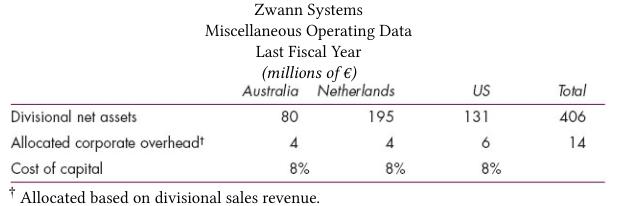

Senior management is in the process of evaluating the relative performance of each division. While the Netherlands division is the largest and generates the most profit, this division also has the largest asset investment, as indicated by the following:

Senior management is in the process of evaluating the relative performance of each division. While the Netherlands division is the largest and generates the most profit, this division also has the largest asset investment, as indicated by the following:

After careful consideration, senior management has decided to examine the relative performance of the three divisions using several alternative measures of performance:

ROI (return on investment as measured by net assets, total assets less liabilities), residual income (net profit less the cost of capital times net assets), and both of these measures after subtracting allocated corporate overhead from divisional profit. The cost of capital in each division is estimated to be the same: 8 percent (assume that this 8 percent estimate is accurate).

There has been much debate about whether corporate overhead should be allocated to the divisions and subtracted from divisional profit. Senior management has decided to allocate back to each division the portion of corporate overhead that is incurred to support and manage the divisions. The allocated corporate overhead items include global marketing, legal expenses, accounting, and administration. Sales revenue has been selected as the allocation base. It is simple to use and best represents the causeand-effect relation between the divisions and the generation of corporate overhead.

a. Calculate ROI and residual income (1) before any corporate overhead allocations, and (2) after corporate overhead allocations for each division.

b. Discuss the differences among the various performance measures.

c. Based on the data presented in the case, evaluate the relative performance of the three operating divisions. Which division do you think performed the best and which performed the worst?

Step by Step Answer:

Management Accounting In A Dynamic Environment

ISBN: 9780415839020

1st Edition

Authors: Cheryl S McWatters, Jerold L Zimmerman