Question: Multi-National Enterprises (MNE) operates in two countries, X and Y, with tax rates of 40 percent and 10 percent respectively. Production costs are exactly the

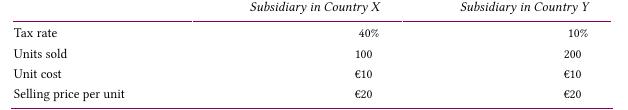

Multi-National Enterprises (MNE) operates in two countries, X and Y, with tax rates of 40 percent and 10 percent respectively. Production costs are exactly the same in each country. The following summarizes the operating data for the two subsidiaries of MNE.

(All data have been converted to euros to simplify the example.)

a. If each operating unit of MNE produces and sells only in its local country, is treated as a separate company, and each unit pays taxes only in the country of its operations, what is MNE’s total tax bill?

b. Suppose that MNE’s subsidiary in country Y manufactures all the output sold in both countries. It ships the output to the MNE subsidiary in country X that sells the product. The transfer price is set at €20. There are no costs of shipping the units from Y to X. If each country taxes only those profits that occur within its jurisdiction, again calculate MNE’s total tax liability.

c. Now suppose that the MNE’s subsidiary in country X manufactures all the output sold in both countries. It ships the output to the MNE subsidiary in country Y that sells the product. Again, there are no costs of shipping the units from Y to X.

If each country taxes only those profits that occur within its jurisdiction, what transfer price must be set to minimize MNE’s total tax liability?

Tax rate Units sold Unit cost Selling price per unit Subsidiary in Country X Subsidiary in Country Y 40% 10% 100 200 10 10 20 20

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts