Spoilage with Three Departments-Weighted Average Method Ballinger Paper Products manufactures a high quality paper box. The box

Question:

Spoilage with Three Departments-Weighted Average Method Ballinger Paper Products manufactures a high quality paper box. The box department applies two separate operations-cutting and folding. The paper is first cut and trimmed to the dimensions of a box form by one machine group. One square foot of paper is equivalent to four box forms. The trimmings from this process have no scrap value. Box forms are then creased and folded (i.e., completed) by a second machine group. Any partially processed boxes in the department are cut box forms that are ready for creasing and folding. These partly processed boxes are considered \(50 \%\) complete as to labor and overhead. The materials department maintains an inventory of paper in sufficient quantities to permit continuous processing, and transfers to the box department are made as needed. Immediately after folding, all good boxes are transferred to the finished goods department.

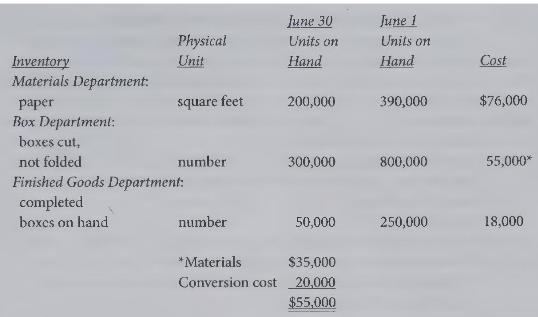

During June, 20X1, the materials department purchased \(1,210,000\) square feet of unprocessed paper for \(\$ 244,000\). Conversion costs for the month were \(\$ 226,000\). A quantity equal to 30,000 boxes was spoiled during paper cutting, and 70,000 boxes were spoiled during folding. All spoilage has a zero salvage value, is considered normal and cannot be reprocessed. All spoilage loss is allocated between the completed units and partially processed boxes. Ballinger applies the weighted average cost method to all inventories. Inventory data for June are given below:

Prepare the following for the month of June, 20X1:

(a) A report of cost of paper used for the Materials Department.

(b) A schedule showing the physical flow of units (including beginning and ending inventories) in the Materials Department, in the Box Department and in the Finished Goods Department.

(c) A schedule showing the computation of equivalent units produced for materials and conversion costs in the Box Department.

(d) A schedule showing the computation of unit costs for the Box Department.

(e) A report of inventory valuation and cost of completed units for the Box Department.

(f) A schedule showing the computation of unit costs for the Finished Goods Department.

(g) A report of inventory valuation and cost of units sold for the Finished Goods Department.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline