Banden Ltd is a highly geared company that wishes to expand its operations. Six possible capital investments

Question:

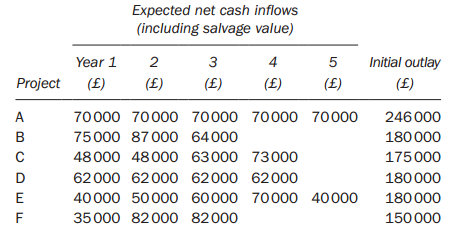

Banden Ltd is a highly geared company that wishes to expand its operations. Six possible capital investments have been identified, but the company only has access to a total of ?620 000. The projects are not divisible and may not be postponed until a future period. After the projects end it is unlikely that similar investment opportunities will occur:

Projects A and E are mutually exclusive. All projects are believed to be of similar risk to the company?s existing capital investments. Any surplus funds may be invested in the money market to earn a return of 9 percent per year. The money market may be assumed to be an efficient market. Banden?s cost of capital is 12 percent per year.

Required:

(a) Calculate:

(i) The expected net present value.

(ii) The expected profitability index associated with each of the six projects, and rank the projects according to both of these investment appraisal methods. Explain brifely why these rankings differ.

(b) Give reasoned advice to Banden Ltd recommending which projects should be selected.

(c) A director of the company has suggested that using the company?s normal cost of capital might not be appropriate in a capital rationing situation. Explain whether you agree with the director.

(d) The director has also suggested the use of linear or integer programming to assist with the selection of projects. Discuss the advantages and disadvantages of these mathematical programming methods to Banden Ltd.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Capital Rationing

Capital rationing is the act of placing restrictions on the amount of new investments or projects undertaken by a company. Capital rationing is the decision process used to select capital projects when there is a limited amount of funding available.... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer: