Brafire manufactures small, portable electric fires. It has operated an absorption costing system since it started many

Question:

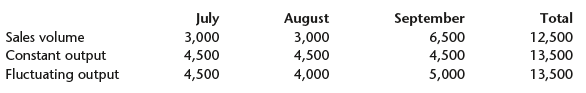

Brafire manufactures small, portable electric fires. It has operated an absorption costing system since it started many years ago. However, the new managing director (who is studying part time for an MBA) has recently learned of the possibility of using a variable costing system as an alternative to the company’s usual approach. He decides to investigate this further by applying both systems to next quarter’s budget (shown below). To provide a good comparison, the output will be shown at both a constant level and a fluctuating one.

Budget for quarter 3 (units):

There will be 500 fi res in stock on 1 July. The selling price is £30 and the cost structure is as follows:

......................................................................... £/unitDirect materials................................................. 4.00Direct labour...................................................... 1.50Variable production overheads....................... 0.50Fixed production overheads*.......................... 6.00Fixed marketing overheads*............................ 4.00Total cost........................................................... 16.00* These figures are based on a constant monthly production level of 4,500 fires.

Tasks:Produce a budgeted profit and loss account for internal management reporting using the following four bases:1. Absorption costing and constant output levels.2. Variable costing and constant output levels.3. Absorption costing and fluctuating output levels.4. Variable costing and fluctuating output levels.Comment on your findings.

Step by Step Answer:

Managerial Accounting Decision Making and Performance Management

ISBN: 978-0273764489

4th edition

Authors: Ray Proctor