A company that manufactures recreational pedal boats has approached Mike Cichanowski to ask if he would be

Question:

A company that manufactures recreational pedal boats has approached Mike Cichanowski to ask if he would be interested in using Current Designs’ rotomould expertise and equipment to produce some of the pedal boat components. Mike is intrigued by the idea and thinks it would be an interesting way of complementing the present product line.

One of Mike’s hesitations about the proposal is that the pedal boats are a diff erent shape than the kayaks that Current Designs produces. As a result, the company would need to buy an additional rotomould oven in order to produce the pedal boat components. This project clearly involves risks, and Mike wants to make sure that the returns justify the risks. In this case, since this is a new venture, Mike thinks that a 15% discount rate is appropriate to use to evaluate the project.

As an intern at Current Designs, Mike has asked you to prepare an initial evaluation of this proposal. To aid in your analysis, he has provided the following information and assumptions.

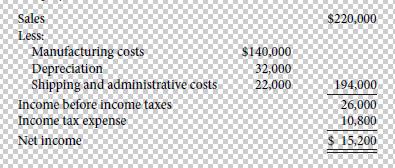

1. The new rotomould oven will have a cost of $256,000, a salvage value of $0, and an 8-year useful life. Straight-line depreciation will be used.2. The projected revenues, costs, and results for each of the 8 years of this project are as follows.

Instructions

(a) Calculate the annual rate of return. (Round to two decimal places.)

(b) Calculate the payback period. (Round to two decimal places.)

(c) Calculate the NPV using a discount rate of 9%. (Round to nearest dollar.) Should the proposal be accepted using this discount rate?

(d) Calculate the NPV using a discount rate of 15%. (Round to nearest dollar.) Should the proposal be accepted using this discount rate?

Step by Step Answer:

Managerial Accounting Tools for Business Decision Making

ISBN: 978-1118856994

4th Canadian edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso, Ibrahim M. Aly