Dowell Company produces a single product. Its income statements under absorption costing for its first two years

Question:

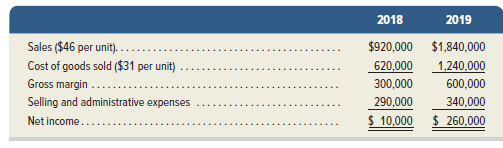

Dowell Company produces a single product. Its income statements under absorption costing for its first two years of operation follow.

Additional Information

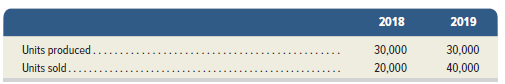

a. Sales and production data for these first two years follow.

b. Variable cost per unit and total fixed costs are unchanged during 2018 and 2019. The company?s $31 per unit product cost consists of the following.

Direct materials ............................................................... $ 5Direct labor ......................................................................... 9Variable overhead .............................................................. 7Fixed overhead ($300,000?30,000 units) ........................ 10Total product cost per unit ............................................ $31

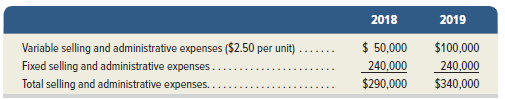

c. Selling and administrative expenses consist of the following.

Required

1. Prepare income statements for the company for each of its first two years under variable costing.

2. Prepare a table as in Exhibit 6.12 to convert variable costing income to absorption costing income for both 2018 and 2019.

Step by Step Answer:

Managerial Accounting

ISBN: 978-1260482935

7th edition

Authors: John J Wild, Ken W. Shaw, Barbara Chiappetta