Kramer Corporation is an office supplier dealing in a number of different products. It currently allocates its

Question:

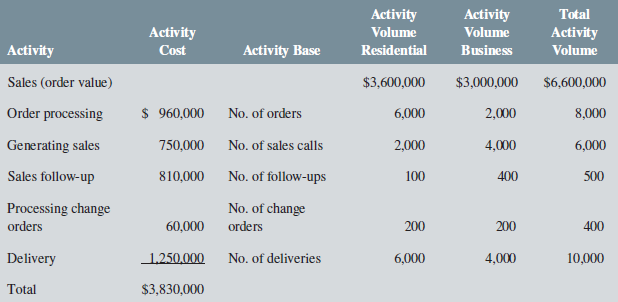

Kramer Corporation is an office supplier dealing in a number of different products. It currently allocates its ordering and delivery costs to its residential and business customer groups on the basis of order value. However, the company has recently decided to implement activity-based costing starting in 20X4 to assign these costs to customers. Key data for 20X3 are as follows:

Kramer has 3,000 residential customers and 750 business customers.

Required:

1. Compute the cost per customer for residential and business customers for 20X3, using the current system of cost allocation.

2. Assume that the 20X3 data will hold for 20X4. Compute the cost per customer for residential and business customers for 20X4 using the proposed system of cost allocation. In doing so, calculate the overhead allocation rate for each activity, and use these rates to assign costs to the two customer groups.?

3. Explain the difference between the two cost allocation systems.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan