Lane Company manufactures a single product that requires a great deal of hand labour. Overhead cost is

Question:

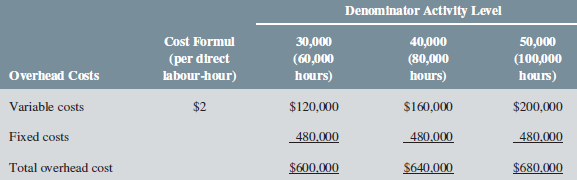

Lane Company manufactures a single product that requires a great deal of hand labour. Overhead cost is applied on the basis of direct labour-hours. The company?s condensed flexible budget for manufacturing overhead follows:

The company?s product requires 1.5 kilograms of material that has a standard cost of $14 per kilogram and 2 hours of direct labour time that has a standard rate of $4.50 per hour.

The company?s facility has a practical capacity of 40,000 units. This was also the planned volume of production for the most recent year. Actual activity and costs for the year were as follows:

Number of units produced..........................................42,000Actual direct labour-hours worked.............................85,000Actual variable overhead cost incurred.................$163,500Actual fixed overhead cost incurred.......................$483,000

Required:

1. Compute the predetermined overhead rate for the year for the variable and fixed overhead costs. What is the total overhead allocation rate?

2. Prepare a standard cost card for the company?s product; show the details for all manufacturing costs on your standard cost card.

3. Do the following:

a. Compute the standard hours allowed for the year?s production.

b. Complete the following manufacturing overhead T-account for the year:

4. Determine the reason for any under- or overapplied overhead for the year by computing the variable overhead spending and efficiency variances and the fixed overhead budget and volume variances.

5. Suppose the company had chosen 85,000 direct labour-hours as the denominator activity level, rather than 80,000 hours. State which, if any, of the variances computed in part (4) would have changed, and explain how the variance(s) would have changed. No computations are necessary.

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan