Mignon Company has estimated overhead of $50,000 in 2022 ($10,000 in Department 1 and $40,000 in Department

Question:

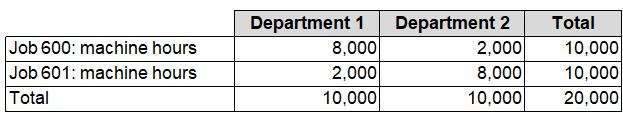

Mignon Company has estimated overhead of $50,000 in 2022 ($10,000 in Department 1 and $40,000 in Department 2), and estimates a total of 10,000 machine hours in each of its two departments (20,000 machine hours total). The company has two jobs. Each job produces 4,000 units. Both jobs pass through two departments. Department 1 incurs $10,000 of overhead. Department 2 incurs $40,000 of overhead. The jobs use the following actual machine hours in each department:

a. If the company allocates overhead based on total machine hours, how much will be allocated to each job and each unit?

b. If the company uses departmental rates based on machine hours for each department, how much will be allocated to each job and each unit?

c. Which approach should Mignon use: single rate based on total hours or departmental rates? Why? Be specific.

d. Which poor business decisions would be affected by the wrong choice of overhead allocation bases?

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope