Consider a lognormal Libor Market Model. For simplicity, assume that Libor rates apply over 1y periods. Take

Question:

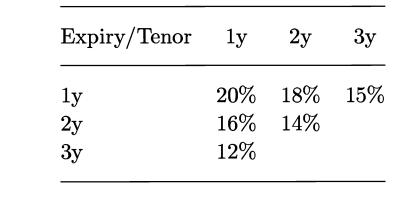

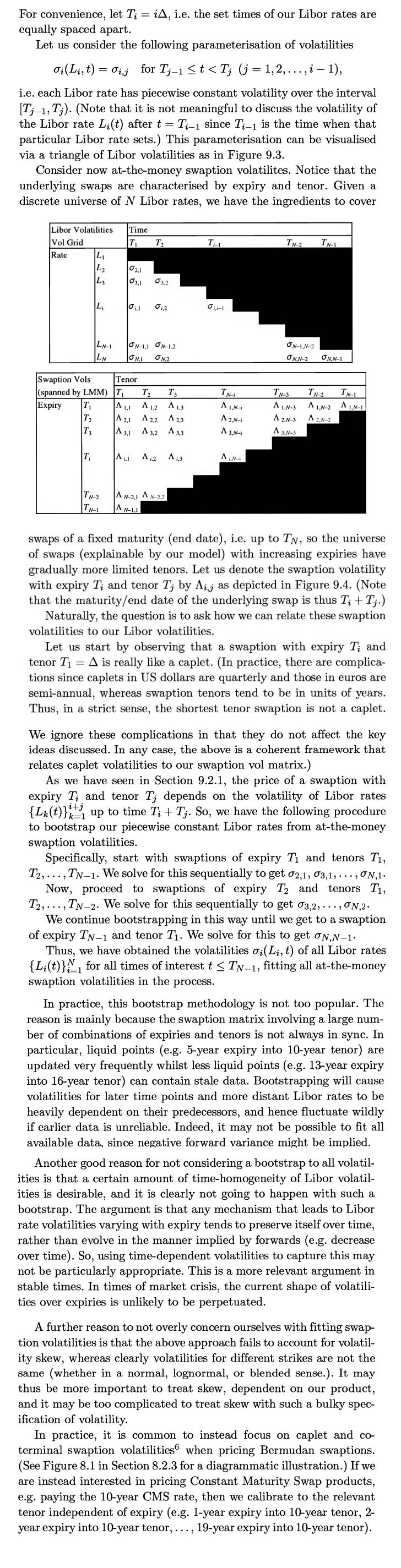

Consider a lognormal Libor Market Model. For simplicity, assume that Libor rates apply over 1y periods. Take current Libor rates to be flat at 3%. Using the discussion on the volatility triangle in Section 9.2.2 and the swaption approximation in Section 9.2.3, obtain the forward vol structure given the following grid of lognormal swaption vols.

Section 9.2.2

Section 9.2.3

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: