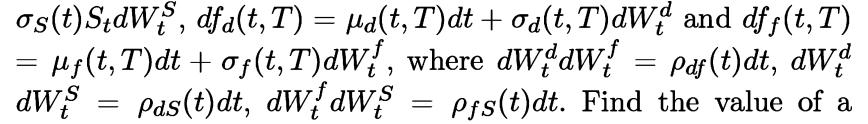

Consider the following parameterisation based on Gaussian interest rates and lognormal spot FX : dS t =

Question:

Consider the following parameterisation based on Gaussian interest rates and lognormal spot FX : dSt = (rt – rƒt) Stdt +  quanto Libor rate, i.e. where the Libor rate LT (set at time T, with accrual fraction Ƭ and paid at time T + Ƭ) is in the foreign currency but paid in the domestic currency without conversion at the FX rate.

quanto Libor rate, i.e. where the Libor rate LT (set at time T, with accrual fraction Ƭ and paid at time T + Ƭ) is in the foreign currency but paid in the domestic currency without conversion at the FX rate.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: