Take the actual SABR formula per Section 6.2.1 with 0 = 0.5%, = 0,

Question:

Take the actual SABR formula per Section 6.2.1 with σ0 = 0.5%, β = 0, ρ = −25%, ν = 30%, and F = 4%. By considering an expiry of 20 years and strikes at 10 basis points increments from 1 % to 2 % inclusive, try and construct an arbitrage involving butterflies (i.e. long a call at strike K − δ short two calls at strike K and long a call at strike K + δ where δ > 0). This is an illustration of the problem of negative densities under the SABR model for very low strikes and long enough expiry.

Section 6.2.1

Transcribed Image Text:

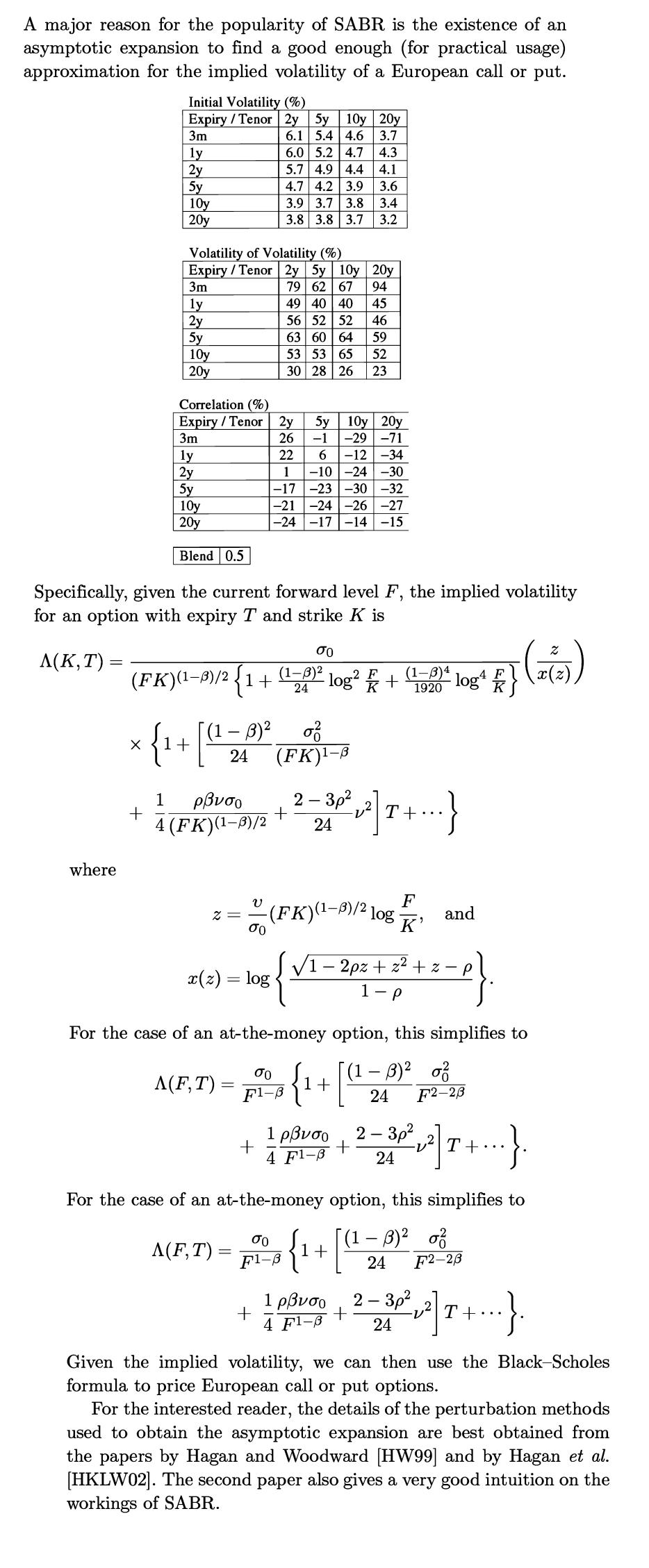

A major reason for the popularity of SABR is the existence of an asymptotic expansion to find a good enough (for practical usage) approximation for the implied volatility of a European call or put. where Initial Volatility (%) Expiry / Tenor 2y 5y 10y 20y 3m 6.1 5.4 4.6 3.7 6.0 5.2 4.7 4.3 5.7 4.9 4.4 4.1 4.7 4.2 3.9 3.6 3.9 3.7 3.8 3.4 3.8 3.8 3.7 3.2 X ly 2y 5y + 10y 20y Volatility of Volatility (%) Expiry / Tenor 2y 5y 10y 3m ly 2y 5y 10y 20y ly 2y 5y 10y 20y Blend 0.5 (FK)(1-3)/2 1 + Correlation (%) Expiry / Tenor 2y 3m 26 1+ (1 - 3)² Specifically, given the current forward level F, the implied volatility for an option with expiry T and strike K is A(K,T) = [(₁ 24 1 ρβυσο 4 (FK)(1-3)/2 z = V σο A(F,T) = 20y 79 62 67 94 49 40 40 x(z) = log 56 52 52 63 60 64 53 53 65 52 30 28 26 23 5y 10y 20y -1 -29 -71 22 6 -12 -34 -10-24 -30 -17 -23 -30 -32 1 -21 -24-26 -27 -24-17-14 -15 σο (1-3)² 2 F (1-3)4 log² + 24 1920 0² (FK)¹-B σο F1-3 + 45 46 59 2-3p² 24 F (FK)(¹-0)/2 log ¹ and √1-2pz +z²+z-p 1+ 2², ²] T +...} For the case of an at-the-money option, this simplifies to σο A(F,T) = ¡{¹+ F1-B 1-p 1ρβνσο + + 4 F1-B 4 F log ¹ K} (x(3)) - 24 F2-28 + + ²] +}. 1ρβνσο + 4 F1-8 2-3p² 24 For the case of an at-the-money option, this simplifies to (1 - 3)² o 24 F2-23 2 - 30/²2, 2] T +... }. 24 Given the implied volatility, we can then use the Black-Scholes formula to price European call or put options. For the interested reader, the details of the perturbation methods used to obtain the asymptotic expansion are best obtained from the papers by Hagan and Woodward [HW99] and by Hagan et al. [HKLW02]. The second paper also gives a very good intuition on the workings of SABR.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answered By

Mamba Dedan

I am a computer scientist specializing in database management, OS, networking, and software development. I have a knack for database work, Operating systems, networking, and programming, I can give you the best solution on this without any hesitation. I have a knack in software development with key skills in UML diagrams, storyboarding, code development, software testing and implementation on several platforms.

4.90+

56+ Reviews

137+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Risk reversals and strangles are described in Section 2.3.2 as packages of calls and puts with strikes on either side of the forward. Using the approximation to the SABR formula per Section 6.2.3,...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Write a version of Gambler that uses two nested while loops or two nested for loops instead of a while loop inside a for loop.

-

Duncan Inc. reported 2011 earnings per share of $3.26 and had no extraordinary items. In 2012, earnings per share on income before extraordinary items was $2.99, and earnings per share on net income...

-

Find the equation and sketch the graph of the following lines. With slope -2, y-intercept (0, 3).

-

(a) To what angle \(\theta_{\max }\) does a coefficient of static friction of 1 correspond? (b) Put, in turn, a coin, a paper clip, a cell phone, and a comb on the cover of this book and tilt the...

-

The Sports Equipment Division of Brandon McCarthy Company is operated as a profit center. Sales for the division were budgeted for 2010 at $900,000. The only variable costs budgeted for the division...

-

(08 Marks) In the Fig.1(c), compare the output of the network, if the activation function is a sigmoid 1 function y=- and (X1, X2) (1, 1). 1+e 1+1 AYY Y YC.) B YC. ye D 46 (06 Marks)

-

Show how the Black-Scholes PDE with final condition V(S,T) V T (S) can be transformed into the initial condition. The exercise is more to convince you that the Black-Scholes PDE is a standard...

-

Consider the Hull-White model with SDE dr t = ,(t)((t) r t )dt + (t)dW t . Following the same logic as we did in the text, determine (t). Can you see why in practice calculating (t) directly is not...

-

For each of the following items, identify whether the item is considered current or noncurrent, and explain why. Inventory Buildings Accounts Receivable Cash Trademarks Accounts Payable Wages Payable...

-

The following table shows the investments of SP Ltd, which are classified into three sub-categories. Assumptions: (a) Returns are independently and normally distributed. (b) Each category is treated...

-

Explain the rationale for the accounting treatment of compound financial instruments under IAS 32. Do you agree with IAS 32s stance?

-

During 2007, the U.S. economy was hit by a price shock when the price of oil increased from around $60 per barrel to around $130 per barrel by June 2008. While inflation increased during the fall of...

-

Scenario A A Co acquired a controlling interest in B Co and entered into the following transactions on acquisition date, 1 July 20x3. Required: Prepare the journal entries that A Co would record to...

-

Some Federal Reserve officials have discussed the possibility of increasing interest rates as a way of fighting potential increases in expected inflation. If the public came to expect higher...

-

Assets and Market Value Klingon Cruisers, Inc. purchased new cloaking machinery three years ago for $9.5 million. The machinery can be sold to the Romulans today for $6.3 million. Klingons current...

-

Repeat the previous problem, but close the positions on September 20. Use the spreadsheet to find the profits for the possible stock prices on September 20. Generate a graph and use it to identify...

-

Identify the reagents you would use to accomplish each of the following transformations: a. b.

-

Identify the reagents you would use to accomplish each of the following transformations: a. b.

-

Propose a plausible synthesis for each of the following transformations: a. b. c. d. e. f. g. h. Br Br

-

The Cullumber Products Co. currently has debt with a market value of $200 million outstanding. The debt consists of 9 percent coupon bonds (semiannual coupon payments) which have a maturity of 15...

-

Compute return on total assets for the current year and one year ago. Current Year: 1 Year Ago: Numerator: Return On Total Assets Denominator: R Return On Total Assets = Return on total assets 1 ==...

-

Bond A has a duration of 4.25 and quoted price of 102.055 and bond B has a duration of 7.60 and a quoted price of 104.750. A $450,000 portfolio of these two bonds has a duration of 5.75. How much (in...

Study smarter with the SolutionInn App