Carmex is dedicated to providing consumers with superior lip balm formulasthat heal, soothe and protect while ensuring

Question:

“Carmex is dedicated to providing consumers with superior lip balm formulas—that heal, soothe and protect— while ensuring lips remain healthy and hydrated,” exclaims Paul Woelbing, president of Carma Laboratories, Inc.

It’s an ambitious mission, but the company has been extraordinarily successful with its 75-year-old product. Woelbing and his management team at Carma Laboratories can attribute their success to a strong brand, a loyal customer base, a growing product line, financial strength, and an exceptional talent for setting prices that achieve company objectives and still provide value to customers. Even during the recession and periods of slow growth the company has been successful. “In a rough economy, shopping habits change,” Woelbing says. “People buy smaller quantities more frequently, but they still need personal care products.”

THE COMPANY:

Carmex was created by Paul’s grandfather, Alfred Woelbing, in his kitchen in Wauwatosa, Wisconsin, in 1937. Alfred had an entrepreneurial spirit and experimented with ingredients such as camphor, menthol, phenol, lanolin, salicylic acid, and cocoa seed butter to make the new product. The name didn’t have any meaning other than Alfred liked the sound of “Carma” and “ex” was a popular suffix for many brands at the time.

He packaged the balm in small glass jars and sold the product for 25 cents from the trunk of his car by making personal sales calls to pharmacies in Wisconsin, Illinois, and Indiana. From the beginning, price and value were important to the product’s success. If pharmacies weren’t initially interested in Carmex, Alfred would leave a dozen jars for free. The samples would sell quickly and soon the pharmacies would place orders for more!

As the company grew, Alfred’s son, Don, joined the business and helped add new products to the company’s offerings. For example, in the 1980s Carmex made its first significant packaging change by also offering the balm in squeezable tubes. In the 1990s Carmex became available in stick form, which had been used by two of Carma’s major competitors—ChapStick and Blistex. In the 2000s Carmex became available in mint, cherry, and strawberry flavors (see Chapter 8 for a description of the research techniques used to identify new flavors). The company also expanded into larger manufacturing facilities, added a new distribution center, and hired its first marketing experts.

Today, the company is led by Alfred’s grandsons, Paul and Eric Woelbing, who continue to manage the company to new levels of success. They appeared on The Oprah Winfrey Show to announce the sale of their billionth jar of Carmex. The governor of Wisconsin declared a Carmex commemoration day to celebrate its 75th anniversary. NBA all-star LeBron James became a promotional partner.

In addition, Pharmacy Times magazine recently named Carmex the number one pharmacist-recommended brand of lip balm for the 15th consecutive year. “We are honored to receive this unprecedented acknowledgement,” said Woelbing. Industry observers estimate that Carma Labs holds approximately 10 percent of the lip balm market. The company distributes its products through major drug, food, and mass merchant retailers, convenience stores, and online in more than 25 countries around the world. The company’s most recent products—Carmex Healing Cream and Carmex Hydrating Lotion—represent a significant step from lip care to skin care. The expanded product line, multichannel distribution, growing volume, international trade, and direct competition make pricing decisions even more important today than when Alfred started the business many years ago.

SETTING PRICES OF CARMEX PRODUCTS:

“There are many factors that go into what results in the retail price in the store,” explains Kirk Hodgdon of Bolin Marketing. As one of the marketing experts who helps Carma Labs with advertising, marketing research, and pricing decisions, Hodgdon uses information about consumer demand, production and material costs profit goals, and competition to help Woelbing and Carmex retailers arrive at specific prices. The many factors often overlap and lead to different prices for different products, channels, and target markets.

“It’s a challenge!” says Hodgdon.

Consumers’ tastes and preferences, for example, influence the price of Carmex products. Bolin director of marketing, Alisa Allen, explains: “Consumers will tell you that they love Carmex because it’s a great value. That doesn’t necessarily mean that it’s the absolute lowest price. It means that it does so much they pay a dollar, and they get all kinds of benefits from the product above and beyond what they would expect.” A single jar of original formula Carmex may sell for $0.99 at mass retailers such as Walmart and Target, and between $1.59 and $1.79 in drug and food retailers such as Walgreens and Kroger.

These prices are a good indication of how important it is to understand consumers when setting prices. “There are magic price points for consumers,” says Allen, “Any time you can drop a penny off, the consumer responds to that price.”

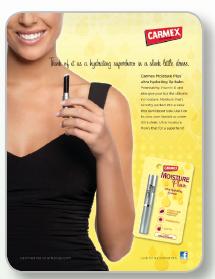

Carmex has also introduced a premium lip balm product, Carmex Moisture Plus, at a retail price between $2.49 and $2.99. Moisture Plus is a lip balm that is packaged in a sleek silver tube, offers a slant tip like lipstick, and is targeted toward women. The formula offers a satin gloss shine and includes vitamin E and aloe for richer moisturization. The upscale package and additional product benefits help Carmex Moisture Plus command a higher price than the traditional Carmex jar and tube.

The cost of the ingredients that make up the Carmex lip balm formulas, the packaging, the manufacturing equipment, and the staffing are also factored into the price of the products. Volumes are a key driver of the cost of packaging and ingredients. For example, Carmex purchases up to 12 million yellow tubes each year for the traditional product, and 2 million sticks each year for the newer Moisture Plus product. The difference in quantities leads to a lower price for the traditional yellow tubes. Similarly, ingredient suppliers, label suppliers, and box suppliers all provide discounts for larger quantities. It is also more efficient for Carmex’s manufacturing facility to make a large batch of traditional formula than it is to make a small batch of Moisture Plus.

Carmex has also reduced its costs with efforts such as its new environmentally friendly Carmex jar which holds the same amount of lip balm but uses 20 percent less plastic, eliminating 35 tons of raw material costs and the related shipping costs!

Carmex also considers retailer margins when it sets its prices. According to Allen, “We typically sell our product to two types of retailers.” There are everyday low pricing (EDLP)

retailers such as Walmart, and highlow retailers such as Walgreens.

EDLP retailers offer consumers the lowest price every day without discounting through promotions.

High-low retailers charge consumers a higher price, but they occasionally discount the product through special promotions which Carmex often supports with “marketing discretionary funds.” Carmex typically offers its products at different prices to EDLP and highlow retailers to allow each retailer to achieve its profit margin goals and to account for Carmex’s promotion expenditures. When the additional expenditures are considered, however, the cost to both types of retailer is similar.

Finally, Carmex considers competitors’ prices when setting its prices. Burt’s Bees, ChapStick, Blistex, and many other brands offer lip balm products, and consumers often compare their prices to the price of Carmex. “We have found through research that it is extremely important that the price gap is not too great,” explains Allen. “If that gap becomes too wide consumers will leave the Carmex brand and purchase a competitor’s product.” When Carmex was preparing to launch its premium Moisture Plus product it conducted a thorough analysis of similar products to ensure that Moisture Plus was in an acceptable price range.........

Questions

1. Which of the four approaches to setting a price does Carmex use for its products? Should one approach be used exclusively?

2. Why do many Carmex product prices end in “9”?

What type of pricing is this called? What should happen to demand when this approach is used?

3. Should cost be a factor in Carmex’s prices? What do you think is a reasonable markup for Carmex and for its retailers?

4. What is the difference between an EDLP retailer and a high-low retailer? Why does Carmex charge them different prices?

5. Conduct an online search of lip balm products and compare the price of a Carmex product with three similar products from competitors. How do you think the competitors are setting their prices?

Step by Step Answer: