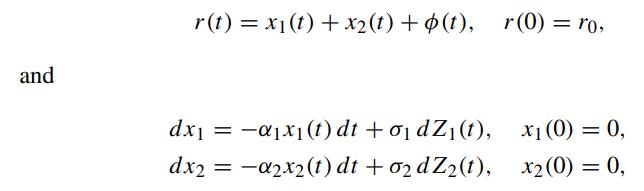

Assume that the dynamics of the short rate process under the risk neutral measure is governed by

Question:

Assume that the dynamics of the short rate process under the risk neutral measure is governed by

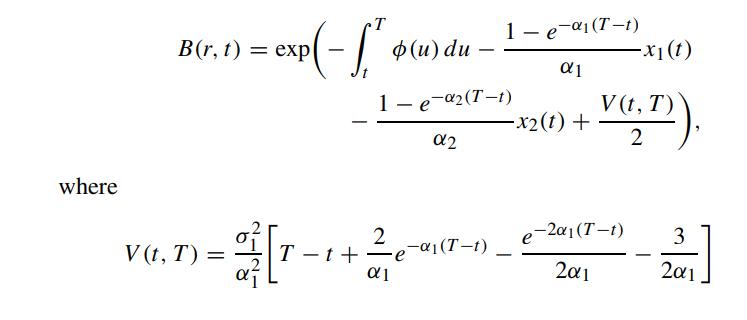

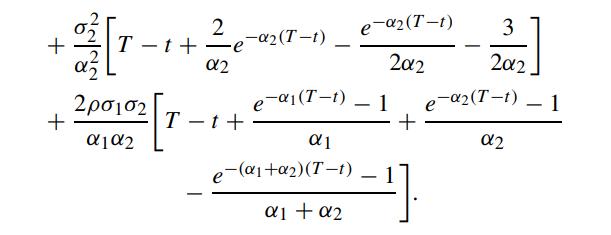

with dZ1(t)dZ2(t) = ρdt. Show that the time-t price of a unit par discount bond is given by

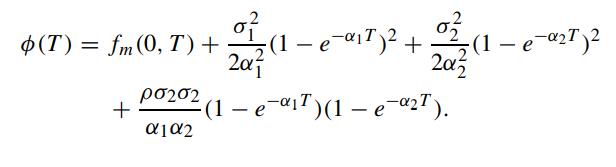

Let fm(0,T) denote the term structure of the forward rates at time 0 for maturity T as implied by the market bond prices. Show that the parameter function ∅(t) can be calibrated to fm(0,T) via the relation

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: