Consider the European zero-rebate up-and-out put option with an exponential barrier: B() = Be , where

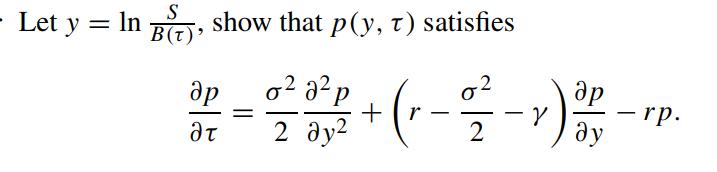

Question:

Consider the European zero-rebate up-and-out put option with an exponential barrier: B(τ) = Be−γτ , where B(τ) > X for all τ . Show that the price of this barrier put option is given by

![8-1 B(t) - [B(r)] + ' PE (B(5) x). 8 = (r = 1) 9 S S 02 p(S, T) = PE(S, T)](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/4/8/1/906655b4b7202add1700481903008.jpg) where pE (S, τ) is the price of the corresponding European vanilla put option. Deduce the price of the corresponding European up-and-in put option with the same barrier.

where pE (S, τ) is the price of the corresponding European vanilla put option. Deduce the price of the corresponding European up-and-in put option with the same barrier.

Transcribed Image Text:

8-1 B(t)² y) - [B(r)] - ' PE (B(5) ² x). 8 = ² (r =1) 9 S S 02 p(S, T) = PE(S, T) —

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

The European zerorebate upandout put option with an exponential barrier BT Be can be expressed in te...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Determine the derivative of each function. (a) y = x2x +5 (2x-6)4 (x+2)3 (b) y: 8. [6 marks]. A tangent to the parabola y = x - 4x + 5 is perpendicular to 2x + 8y + 50. Determine the equation of the...

-

Find the PV and the FV of an investment that makes the following end-of-year payments. The interest rate is 10%. Year 1 2 3 Payment $100 $200 $400 Round your answers to the nearest cent. PV of...

-

Round 3 8 . 1 7 7 6 1 to the nearest whole number

-

Create a T-Account Transaction Account titles Cash d Common stock Supplies Creditors accounts payable) Cash Fees earned Rent expense Cash Creditors(accounts payable) Cash Accounts receivable Fees...

-

Prepare budgetary entries, using general ledger accounts only, for each of the following unrelated situations: a. Anticipated revenues are $10 million; anticipated expenditures and encumbrances are...

-

Martin Towing Company is at the end of its accounting year, December 31, 2014. The following data that must be considered were developed from the companys records and related documents: a. On January...

-

North Shore Architectural Stone, Inc., a company that installs limestone in residential and commercial buildings, agreed to supply and install limestone for a property owned by Joseph Vitacco. North...

-

The following items were selected from among the transactions completed by Aston Martin Inc. during the current year: Apr. 15. Borrowed $225,000 from Audi Company, issuing a 30-day, 6% note for that...

-

Risk of entry Bargaining power of suppliers Bargaining power of buyers Threat of substitutes Power of complement providers Rivalry among established firms in industry Which of the above forces are...

-

Suppose the asset price follows the Geometric Brownian process with drift rate r and volatility under the risk neutral measure Q. Find the density function of the asset price S T at expiration time...

-

Under the risk neutral measure Q, the stochastic process of the logarithm of the asset price x t = ln S t and its instantaneous volatility t are assumed to be governed by where dZ x dZ = dt. All...

-

What are the total impedance, phase angle, and rms current in and LRC circuit connected to a 10.0-kHz, 725-V (rms) source if L = 22.0 mH, R = 8.70 k, and C = 3250 pF?

-

Which of the following would not have a FIFO queue discipline? a. Fast-food restaurant b. Post office c. Checkout line at grocery store d. Emergency room at a hospital

-

What is the vector of state probabilities? Where can it be found in a process?

-

Can policymakers minimize tax avoidance? How?

-

Why is it important to consider arrival characteristics in a queuing system?

-

What is the equilibrium condition? Give a working definition of it.

-

Sharman Athletic Gear Inc (SAG) is considering a special order for 15,000 baseball caps with the logo of East Texas University (ETU) to be purchased by the ETU alumni association. The ETU alumni...

-

Suppose you are comparing just two means. Among the possible statistics you could use is the difference in means, the MAD, or the max min (the difference between the largest mean and the smallest...

-

Discuss some ways that a firm can link its sales promotion activities to its advertising and personal selling effortsso that all of its promotion efforts result in an integrated effort.

-

Indicate the type of sales promotion that a producer might use in each of the following situations and briefly explain your reasons: a. A firm has developed an improved razor blade and obtained...

-

Why wouldnt a producer of toothpaste just lower the price of its product rather than offer consumers a price-off coupon?

-

Question 8 Uncle Larry gifted land on January 1, 20x4, with an FMV of $80,000 to Rebecca that he had originally purchased on January 1, 20x1, for $100,000. On January 1, 20x6, Rebecca sold that land...

-

A successful grocery store wants a. low inventory turnover and high account receivable turnover b. low inventory turnover and low account receivable turnover c. high inventory turnover and high...

-

Stella is assessing the financial stability of a company during a business acquisition. She is looking at the balance sheet of the company during a business meeting. Where can she find information...

Study smarter with the SolutionInn App