Consider the one-dividend American put option model where the discrete dividend at time t d is paid

Question:

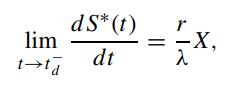

Consider the one-dividend American put option model where the discrete dividend at time td is paid at the known rate λ, that is, the dividend payment is λStd . Show that the slope of the optimal exercise boundary of the American put at time right before td is given by (Meyer, 2001)

where r is the riskless interest rate.

Consider the balance of the gain in interest income from the strike price and the loss in dividend over the differential time interval δt right before td.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: