Let C do (S, ; X,H,r,q) and P uo (S, ; X,H,r,q) denote the price

Question:

Let Cdo(S, τ ; X,H,r,q) and Puo(S, τ ; X,H,r,q) denote the price function of an American down-and-out barrier call and an American up-and-out barrier put, respectively, both with constant barrier level H. Show that the put-call symmetry relation for the prices of the American barrier call and put options is given by (Gao, Huang and Subrahmanyam, 2000)

![]()

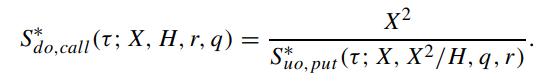

Let S∗do,call (τ ; X,H,r,q) and S∗uo,put(τ ; X,H,r,q) denote the optimal exercise price of the American down-and-out call and American up-and-out put, respectively. Show that

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: