Let the dynamics of the short rate r(t) be governed by the extended Vasicek model Show that

Question:

Let the dynamics of the short rate r(t) be governed by the extended Vasicek model

![dr (t) = [p(t) - ar(t)] dt+ or dZ(t).](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/3/5/608655da3d8310351700635607588.jpg)

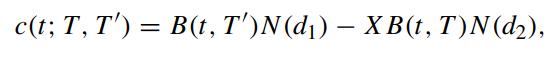

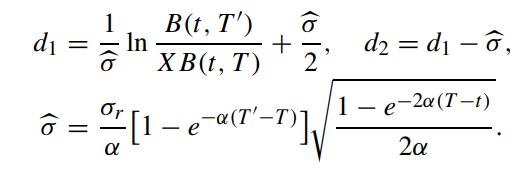

Show that the value of the European call option with strike price X maturity at T on a T’-maturity discount bond is given by

where B(t,T ) is the discount bond price,

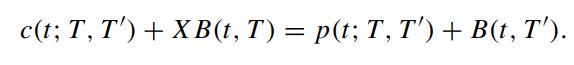

Also, show that the put-call parity relation between the prices of the European put and call options on the same underlying discount bond is given by

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: