Under the risk neutral measure, S t follows the Geometric Brownian process where Let B(t,T) be the

Question:

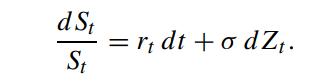

Under the risk neutral measure, St follows the Geometric Brownian process where

Let B(t,T) be the time-t value of the T-maturity discount bond. Under the forward measure QT where B(t,T) is used as the numeraire, show that

![ST or [7] = E'QT B(t,t*) B(t,T)' St St B(t,T)* tt* t> t*.](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/3/4/749655da07d1e9e21700634748739.jpg) Give a financial interpretation of the above result.

Give a financial interpretation of the above result.

Transcribed Image Text:

d St St = ridt+odZ.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

The expression youve provided involves the change of measure from the riskneutral measure to the for...View the full answer

Answered By

Lamya S

Highly creative, resourceful and dedicated High School Teacher with a good fluency in English (IELTS- 7.5 band scorer) and an excellent record of successful classroom presentations.

I have more than 2 years experience in tutoring students especially by using my note making strategies.

Especially adept at teaching methods of business functions and management through a positive, and flexible teaching style with the willingness to work beyond the call of duty.

Committed to ongoing professional development and spreading the knowledge within myself to the blooming ones to make them fly with a colorful wing of future.

I do always believe that more than being a teacher who teaches students subjects,...i rather want to be a teacher who wants to teach students how to love learning..

Subjects i handle :

Business studies

Management studies

Operations Management

Organisational Behaviour

Change Management

Research Methodology

Strategy Management

Economics

Human Resource Management

Performance Management

Training

International Business

Business Ethics

Business Communication

Things you can expect from me :

- A clear cut answer

- A detailed conceptual way of explanation

- Simplified answer form of complex topics

- Diagrams and examples filled answers

4.90+

46+ Reviews

54+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

We would like to price the floor on the composition defined in Problem 8.22 using the LIBOR Market model. Now, we assume that the LIBOR Li(t) follows the arithmetic Brownian process: Problem 8.22...

-

Let Y(t; ) denote the yield at time t for a discount bond with a fixed time to maturity . The average of the constant maturity yield Y(t; ) over a prespecified time period (0,T ] is given by We...

-

The dynamics of the instantaneous forward rate F(t,T ) under the risk neutral measure Q is governed by where (Z 1 (t)Z m (t)) T is an m-dimensional Brownian process under Q. Let (W 1 (t) W m (t)) T...

-

Which of the following is part of Walmarts strategy regarding its supply chain? a) Acquiring e-commerce technology and expertise. b) Opening central warehouses. c) Changing how and when inventory is...

-

In developing an EFE Matrix, would it be advantageous to arrange your opportunities according to the highest weight, and do likewise for your threats? Explain.

-

What are the components of the following queuing systems? Draw and explain the configuration of each. (a) Barbershop. (b) Car Wash. (c) Laundromat, (d) Small grocery store.

-

Assuming the same data as given in problem 9, was the well in each case profitable? Discuss your answer. Problem 9:- Property cost (acquisition cost). Drilling cost (one well). Estimated completion...

-

Music Teachers, Inc., is an educational association for music teachers that has 20,000 members. The association operates from a central headquarters but has local membership chapters throughout the...

-

Based on the Lease Obligations by Year visualization, do the results make sense? Select answer from the options below No. There is a decreasing trend in finance lease and operating lease obligations,...

-

Let the dynamics of the short rate r(t) be governed by the extended Vasicek model Show that the value of the European call option with strike price X maturity at T on a T-maturity discount bond is...

-

Let X(t) denote the exchange rate process in units of the domestic currency per one unit of the foreign currency, and let r d (t) and r f (t) denote the domestic and foreign riskless interest rate,...

-

BQ, Inc., is considering making an offer to purchase iReport Publications. The vice president of finance has collected the following information: BQ also knows that securities analysts expect the...

-

What tradeoffs should be considered in evaluating the merits of adding additional CDCs? What costs are likely to increase and what costs are likely to decrease with this change? Beyond cost, what...

-

Many workplaces encourage their staff to build networks both internally and externally in the organization. This may be through online networks, such as LinkedIn, or by engaging with the community...

-

The following selected ledger accounts of Cameron Company are for February (the second month of its accounting year): Materials Inventory Feb. 1 balance 113,400 February credits 406,800 February...

-

Four sports teams offered Sam 5-year contracts to play football. All four offers include an upfront sign-up bonus, end of year annual payments, and end-of-the contract termination bonus. Sam wishes...

-

6) (10+20) The following theorem holds for any planar graph: There is a set of 0(n) vertices (called the separator set) whose removal from a n-vertex planar graph partitions the graph into disjoint...

-

How many joules of heat are required to melt 15.0 kg of ice at 0C and to raise the temperature of the melted ice to 75C?

-

Extend Algorithms 3.4 and 3.5 to include as output the first and second derivatives of the spline at the nodes.

-

Dread Corporation operates in a high-tax state. The firm asks you for advice on a plan to outsource administrative work done in its home state to independent contractors. This work now costs the...

-

Indicate whether each of the following items should be allocated or apportioned by the taxpayer in computing state corporate taxable income. Assume that the state follows the general rules of UDITPA....

-

Regarding the apportionment formula used to compute state taxable income, does each of the following independent characterizations describe a taxpayer that is based in-state or out-of-state? Explain....

-

Develop a cultural diversity education plan for newly hired staff members. This plan should address specific training needs that you have identified in your case study analysis. Be sure to address...

-

On December 31, 2021 Maiden Company enters into factoring arrangement involving its trade receivables with a carrying amount of P10,000,000 with Surplus Company. The arrangement resulted into the...

-

One scholarly, peer-reviewed journal article on cultural diversity in healthcare organizations. Explain the impact of cultural diversity and personal beliefs on team dynamics. Why is it important...

Study smarter with the SolutionInn App