Show that the bond price for the CoxIngersollRoss model [see (7.2.32a,b)] is a decreasing convex function of

Question:

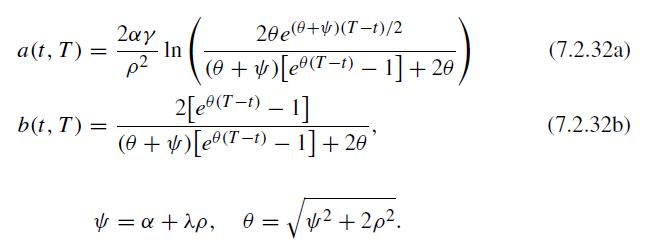

Show that the bond price for the Cox–Ingersoll–Ross model [see (7.2.32a,b)] is a decreasing convex function of the short rate and a decreasing function of time to maturity. Further, show that the bond price is a decreasing convex function of the mean short rate level γ and an increasing concave function of the speed of adjustment α if r(t) > γ . What would be the effects on the bond price when the short rate variance ρ2 and the market price of risk λ increase?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: